| IndiaTV: Business RSS Feed |

Table of Contents - Byju's crisis: Investors issue notice for founders' ouster, US unit files for bankruptcy

- Paytm Payments Bank reassures safety of existing balances after RBI restrictions

- Stock market: Sensex climbs 846 points, Nifty tops 21,950 amid 20 per cent decline in Paytm after budget day

- 'Paytm will keep working beyond February 29', says Vijay Shekhar Sharma after RBI announces curbs

- 56 lakh updated ITRs filed, Rs 4,600 crore taxes collected in two years: CBDT

- Stock market update: Nifty hits fresh record high, Sensex over 1,400 points; RIL surges to new peak

- Will you be able to use Paytm services after February 29? Check UPI, wallet and other details

- Apple India December quarter revenue surges to record high on robust iPhone sales: Tim Cook

- Average monthly GST collections to grow 11 per cent to Rs 1.85 lakh crore in FY25: Revenue Secretary

- Paytm Bank: Money laundering concerns, KYC non-compliance led to ban on PPBL by RBI

- Byju's crisis: Investors issue notice for founders' ouster, US unit files for bankruptcy

- Paytm Payments Bank reassures safety of existing balances after RBI restrictions

- Stock market: Sensex climbs 846 points, Nifty tops 21,950 amid 20 per cent decline in Paytm after budget day

- 'Paytm will keep working beyond February 29', says Vijay Shekhar Sharma after RBI announces curbs

- 56 lakh updated ITRs filed, Rs 4,600 crore taxes collected in two years: CBDT

- Stock market update: Nifty hits fresh record high, Sensex over 1,400 points; RIL surges to new peak

- Will you be able to use Paytm services after February 29? Check UPI, wallet and other details

- Apple India December quarter revenue surges to record high on robust iPhone sales: Tim Cook

- Average monthly GST collections to grow 11 per cent to Rs 1.85 lakh crore in FY25: Revenue Secretary

- Paytm Bank: Money laundering concerns, KYC non-compliance led to ban on PPBL by RBI

- Paytm Payments Bank reassures safety of existing balances after RBI restrictions

- Stock market: Sensex climbs 846 points, Nifty tops 21,950 amid 20 per cent decline in Paytm after budget day

- 'Paytm will keep working beyond February 29', says Vijay Shekhar Sharma after RBI announces curbs

- 56 lakh updated ITRs filed, Rs 4,600 crore taxes collected in two years: CBDT

- Stock market update: Nifty hits fresh record high, Sensex over 1,400 points; RIL surges to new peak

- Will you be able to use Paytm services after February 29? Check UPI, wallet and other details

- Apple India December quarter revenue surges to record high on robust iPhone sales: Tim Cook

- Average monthly GST collections to grow 11 per cent to Rs 1.85 lakh crore in FY25: Revenue Secretary

- Paytm Bank: Money laundering concerns, KYC non-compliance led to ban on PPBL by RBI

- SBI comes forward to rescue Paytm customers, says 'will act on RBI direction'

- Paytm Payments Bank reassures safety of existing balances after RBI restrictions

- Stock market: Sensex climbs 846 points, Nifty tops 21,950 amid 20 per cent decline in Paytm after budget day

- 'Paytm will keep working beyond February 29', says Vijay Shekhar Sharma after RBI announces curbs

- 56 lakh updated ITRs filed, Rs 4,600 crore taxes collected in two years: CBDT

- Stock market update: Nifty hits fresh record high, Sensex over 1,400 points; RIL surges to new peak

- Will you be able to use Paytm services after February 29? Check UPI, wallet and other details

- Apple India December quarter revenue surges to record high on robust iPhone sales: Tim Cook

- Average monthly GST collections to grow 11 per cent to Rs 1.85 lakh crore in FY25: Revenue Secretary

- Paytm Bank: Money laundering concerns, KYC non-compliance led to ban on PPBL by RBI

- SBI comes forward to rescue Paytm customers, says 'will act on RBI direction'

- Stock market: Sensex climbs 846 points, Nifty tops 21,950 amid 20 per cent decline in Paytm after budget day

- 'Paytm will keep working beyond February 29', says Vijay Shekhar Sharma after RBI announces curbs

- 56 lakh updated ITRs filed, Rs 4,600 crore taxes collected in two years: CBDT

- Stock market update: Nifty hits fresh record high, Sensex over 1,400 points; RIL surges to new peak

- Will you be able to use Paytm services after February 29? Check UPI, wallet and other details

- Apple India December quarter revenue surges to record high on robust iPhone sales: Tim Cook

- Average monthly GST collections to grow 11 per cent to Rs 1.85 lakh crore in FY25: Revenue Secretary

- Paytm Bank: Money laundering concerns, KYC non-compliance led to ban on PPBL by RBI

- SBI comes forward to rescue Paytm customers, says 'will act on RBI direction'

- Traders' body CAIT asks Paytm merchants to switch to other payment apps after RBI ban

- Stock market: Sensex climbs 846 points, Nifty tops 21,950 amid 20 per cent decline in Paytm after budget day

- 'Paytm will keep working beyond February 29', says Vijay Shekhar Sharma after RBI announces curbs

- 56 lakh updated ITRs filed, Rs 4,600 crore taxes collected in two years: CBDT

- Stock market update: Nifty hits fresh record high, Sensex over 1,400 points; RIL surges to new peak

- Will you be able to use Paytm services after February 29? Check UPI, wallet and other details

- Apple India December quarter revenue surges to record high on robust iPhone sales: Tim Cook

- Average monthly GST collections to grow 11 per cent to Rs 1.85 lakh crore in FY25: Revenue Secretary

- Paytm Bank: Money laundering concerns, KYC non-compliance led to ban on PPBL by RBI

- SBI comes forward to rescue Paytm customers, says 'will act on RBI direction'

- Traders' body CAIT asks Paytm merchants to switch to other payment apps after RBI ban

- Stock market: Sensex climbs 846 points, Nifty tops 21,950 amid 20 per cent decline in Paytm after budget day

- 'Paytm will keep working beyond February 29', says Vijay Shekhar Sharma after RBI announces curbs

- 56 lakh updated ITRs filed, Rs 4,600 crore taxes collected in two years: CBDT

- Stock market update: Nifty hits fresh record high, Sensex over 1,400 points; RIL surges to new peak

- Will you be able to use Paytm services after February 29? Check UPI, wallet and other details

- Apple India December quarter revenue surges to record high on robust iPhone sales: Tim Cook

- Average monthly GST collections to grow 11 per cent to Rs 1.85 lakh crore in FY25: Revenue Secretary

- Paytm Bank: Money laundering concerns, KYC non-compliance led to ban on PPBL by RBI

- SBI comes forward to rescue Paytm customers, says 'will act on RBI direction'

- Traders' body CAIT asks Paytm merchants to switch to other payment apps after RBI ban

|

Friday 02 February 2024 02:29 AM UTC+00  A group of about six investors in Think and Learn Private Limited, the company behind BYJU's brand, have initiated an extraordinary general meeting (EGM) to address concerns within the edtech major and seek the removal of founders' control over the company, according to sources familiar with the matter. |

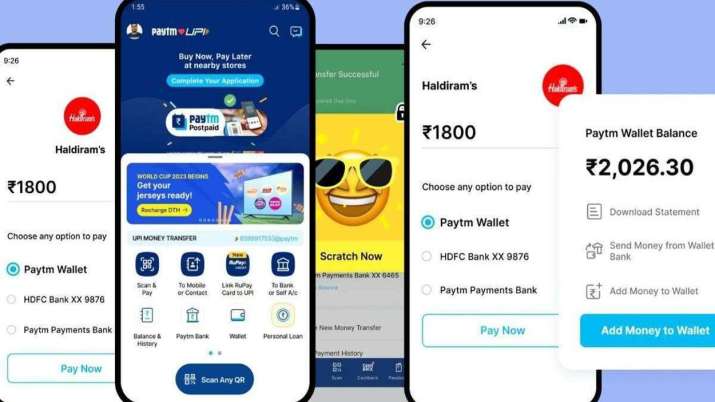

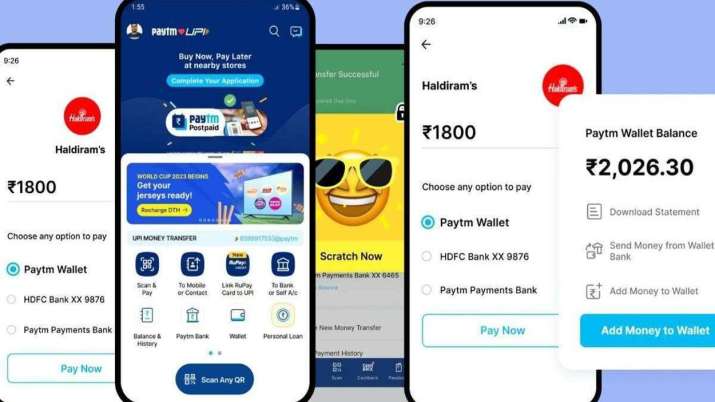

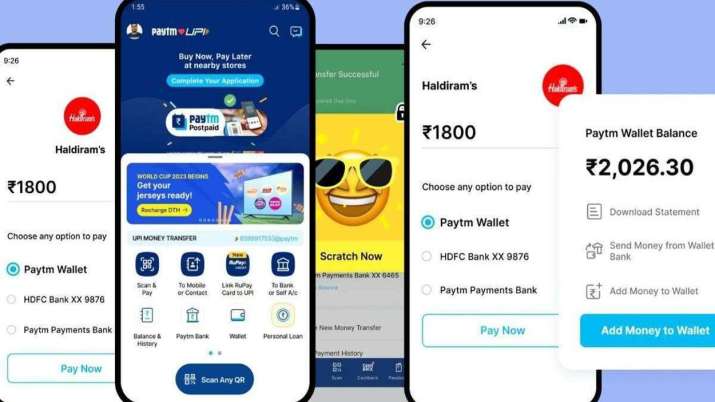

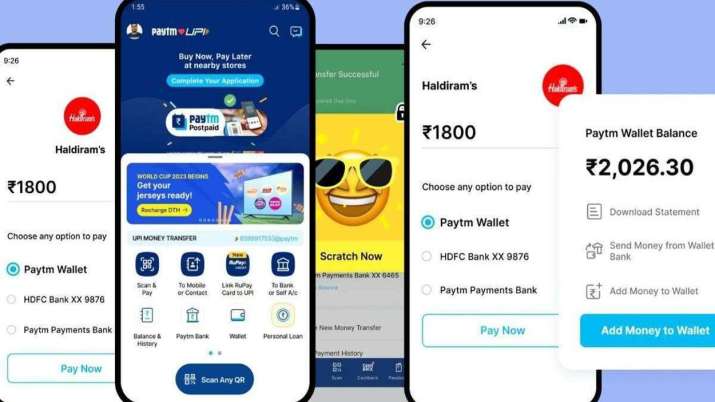

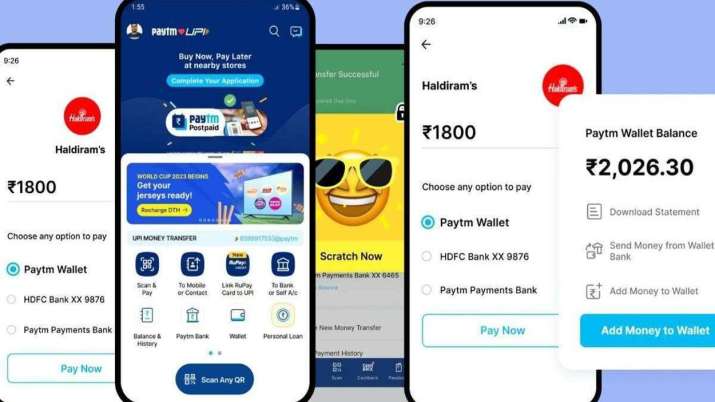

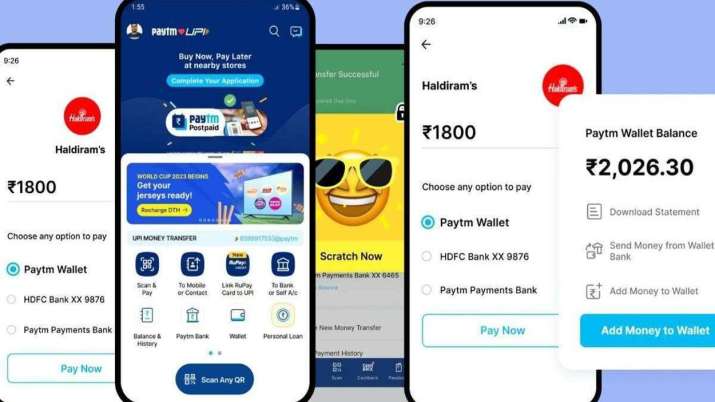

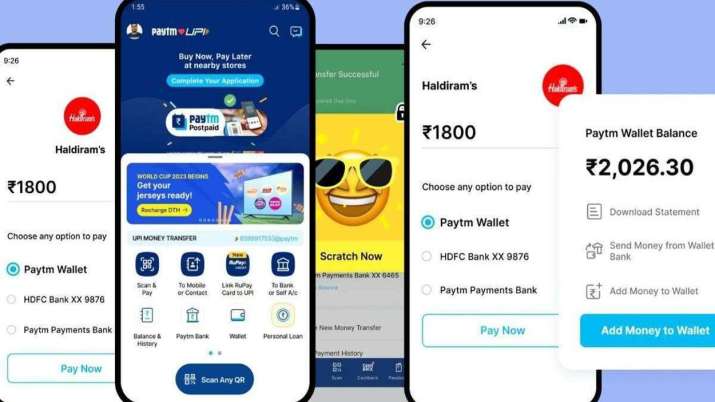

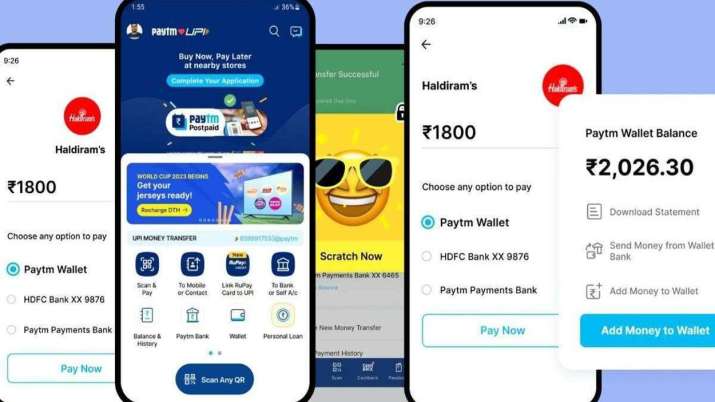

Friday 02 February 2024 03:29 AM UTC+00  Paytm Payments Bank has reassured its customers that their existing balances are safe, following the Reserve Bank of India's (RBI) directive restricting the bank from accepting new deposits or allowing credit transactions after February 29, 2024. |

Friday 02 February 2024 04:15 AM UTC+00  Benchmark equity indices rebounded strongly in early trade on Friday, following a global market rally and increased buying in Reliance Industries and ICICI Bank. The 30-share BSE Sensex surged by 846.64 points to 72,491.94, while the Nifty rose by 256.55 points to 21,954. |

Friday 02 February 2024 04:38 AM UTC+00  Paytm CEO Vijay Shekhar Sharma reassured users on Friday, addressing concerns after the Reserve Bank of India (RBI) ordered its banking arm to cease accepting new deposits. |

Friday 02 February 2024 05:46 AM UTC+00  The income tax department has collected around Rs 4,600 crore in taxes from 56 lakh updated income tax returns filed by taxpayers in the past two years, according to Nitin Gupta, the Chief of the Central Board of Direct Taxes (CBDT). |

Friday 02 February 2024 06:48 AM UTC+00  In the late morning trading on Friday, the NSE Nifty surged to a record high by gaining 429 points and trading at 22,126.80, while the BSE Sensex rose by 1,444 points, reaching a day high of 73,089.40. |

Friday 02 February 2024 07:43 AM UTC+00  In response to the Reserve Bank of India's (RBI) recent restrictions on Paytm Payments Bank, Paytm CEO Vijay Shekhar Sharma has reassured users that the Paytm app will continue to operate normally beyond February 29. |

Friday 02 February 2024 08:08 AM UTC+00  Apple's revenue in India reached a record high in the December 2023 quarter, driven by robust sales of iPhones, according to Apple CEO Tim Cook. |

Friday 02 February 2024 09:14 AM UTC+00  The government expects the average monthly Goods and Services Tax (GST) collections to increase by 11 per cent to reach around Rs 1.85 lakh crore in the fiscal year 2024-25, compared to approximately Rs 1.66 lakh crore in the current fiscal year, according to Revenue Sanjay Malhotra. |

Saturday 03 February 2024 12:45 PM UTC+00  Paytm Payments Bank: Paytm Payments Bank: Money laundering concerns and questionable dealings of hundreds of crores of rupees between popular wallet Paytm and its lesser-known banking arm had led the Reserve Bank of India (RBI) to clamp down on tech poster boy Vijay Sekhar Sharma-run entities, sources said. |

Friday 02 February 2024 02:29 AM UTC+00  A group of about six investors in Think and Learn Private Limited, the company behind BYJU's brand, have initiated an extraordinary general meeting (EGM) to address concerns within the edtech major and seek the removal of founders' control over the company, according to sources familiar with the matter. |

Friday 02 February 2024 03:29 AM UTC+00  Paytm Payments Bank has reassured its customers that their existing balances are safe, following the Reserve Bank of India's (RBI) directive restricting the bank from accepting new deposits or allowing credit transactions after February 29, 2024. |

Friday 02 February 2024 04:15 AM UTC+00  Benchmark equity indices rebounded strongly in early trade on Friday, following a global market rally and increased buying in Reliance Industries and ICICI Bank. The 30-share BSE Sensex surged by 846.64 points to 72,491.94, while the Nifty rose by 256.55 points to 21,954. |

Friday 02 February 2024 04:38 AM UTC+00  Paytm CEO Vijay Shekhar Sharma reassured users on Friday, addressing concerns after the Reserve Bank of India (RBI) ordered its banking arm to cease accepting new deposits. |

Friday 02 February 2024 05:46 AM UTC+00  The income tax department has collected around Rs 4,600 crore in taxes from 56 lakh updated income tax returns filed by taxpayers in the past two years, according to Nitin Gupta, the Chief of the Central Board of Direct Taxes (CBDT). |

Friday 02 February 2024 06:48 AM UTC+00  In the late morning trading on Friday, the NSE Nifty surged to a record high by gaining 429 points and trading at 22,126.80, while the BSE Sensex rose by 1,444 points, reaching a day high of 73,089.40. |

Friday 02 February 2024 07:43 AM UTC+00  In response to the Reserve Bank of India's (RBI) recent restrictions on Paytm Payments Bank, Paytm CEO Vijay Shekhar Sharma has reassured users that the Paytm app will continue to operate normally beyond February 29. |

Friday 02 February 2024 08:08 AM UTC+00  Apple's revenue in India reached a record high in the December 2023 quarter, driven by robust sales of iPhones, according to Apple CEO Tim Cook. |

Friday 02 February 2024 09:14 AM UTC+00  The government expects the average monthly Goods and Services Tax (GST) collections to increase by 11 per cent to reach around Rs 1.85 lakh crore in the fiscal year 2024-25, compared to approximately Rs 1.66 lakh crore in the current fiscal year, according to Revenue Sanjay Malhotra. |

Saturday 03 February 2024 12:45 PM UTC+00  Paytm Payments Bank: Paytm Payments Bank: Money laundering concerns and questionable dealings of hundreds of crores of rupees between popular wallet Paytm and its lesser-known banking arm had led the Reserve Bank of India (RBI) to clamp down on tech poster boy Vijay Sekhar Sharma-run entities, sources said. |

Friday 02 February 2024 03:29 AM UTC+00  Paytm Payments Bank has reassured its customers that their existing balances are safe, following the Reserve Bank of India's (RBI) directive restricting the bank from accepting new deposits or allowing credit transactions after February 29, 2024. |

Friday 02 February 2024 04:15 AM UTC+00  Benchmark equity indices rebounded strongly in early trade on Friday, following a global market rally and increased buying in Reliance Industries and ICICI Bank. The 30-share BSE Sensex surged by 846.64 points to 72,491.94, while the Nifty rose by 256.55 points to 21,954. |

Friday 02 February 2024 04:38 AM UTC+00  Paytm CEO Vijay Shekhar Sharma reassured users on Friday, addressing concerns after the Reserve Bank of India (RBI) ordered its banking arm to cease accepting new deposits. |

Friday 02 February 2024 05:46 AM UTC+00  The income tax department has collected around Rs 4,600 crore in taxes from 56 lakh updated income tax returns filed by taxpayers in the past two years, according to Nitin Gupta, the Chief of the Central Board of Direct Taxes (CBDT). |

Friday 02 February 2024 06:48 AM UTC+00  In the late morning trading on Friday, the NSE Nifty surged to a record high by gaining 429 points and trading at 22,126.80, while the BSE Sensex rose by 1,444 points, reaching a day high of 73,089.40. |

Friday 02 February 2024 07:43 AM UTC+00  In response to the Reserve Bank of India's (RBI) recent restrictions on Paytm Payments Bank, Paytm CEO Vijay Shekhar Sharma has reassured users that the Paytm app will continue to operate normally beyond February 29. |

Friday 02 February 2024 08:08 AM UTC+00  Apple's revenue in India reached a record high in the December 2023 quarter, driven by robust sales of iPhones, according to Apple CEO Tim Cook. |

Friday 02 February 2024 09:14 AM UTC+00  The government expects the average monthly Goods and Services Tax (GST) collections to increase by 11 per cent to reach around Rs 1.85 lakh crore in the fiscal year 2024-25, compared to approximately Rs 1.66 lakh crore in the current fiscal year, according to Revenue Sanjay Malhotra. |

Saturday 03 February 2024 12:45 PM UTC+00  Paytm Payments Bank: Paytm Payments Bank: Money laundering concerns and questionable dealings of hundreds of crores of rupees between popular wallet Paytm and its lesser-known banking arm had led the Reserve Bank of India (RBI) to clamp down on tech poster boy Vijay Sekhar Sharma-run entities, sources said. |

Sunday 04 February 2024 06:21 AM UTC+00  State Bank of India (SBI) has come forward to help Paytm customers following a ban on the latter's activities by the Reserve Bank of India from March 1. SBI Chairman Dinesh Kumar Khara said, "If there is a direction from the RBI to any effect, we will rescue the once-storied Paytm." However, he said that the company has no plans of going directly into the matter addressing the media during the third quarter earnings. |

Friday 02 February 2024 03:29 AM UTC+00  Paytm Payments Bank has reassured its customers that their existing balances are safe, following the Reserve Bank of India's (RBI) directive restricting the bank from accepting new deposits or allowing credit transactions after February 29, 2024. |

Friday 02 February 2024 04:15 AM UTC+00  Benchmark equity indices rebounded strongly in early trade on Friday, following a global market rally and increased buying in Reliance Industries and ICICI Bank. The 30-share BSE Sensex surged by 846.64 points to 72,491.94, while the Nifty rose by 256.55 points to 21,954. |

Friday 02 February 2024 04:38 AM UTC+00  Paytm CEO Vijay Shekhar Sharma reassured users on Friday, addressing concerns after the Reserve Bank of India (RBI) ordered its banking arm to cease accepting new deposits. |

Friday 02 February 2024 05:46 AM UTC+00  The income tax department has collected around Rs 4,600 crore in taxes from 56 lakh updated income tax returns filed by taxpayers in the past two years, according to Nitin Gupta, the Chief of the Central Board of Direct Taxes (CBDT). |

Friday 02 February 2024 06:48 AM UTC+00  In the late morning trading on Friday, the NSE Nifty surged to a record high by gaining 429 points and trading at 22,126.80, while the BSE Sensex rose by 1,444 points, reaching a day high of 73,089.40. |

Friday 02 February 2024 07:43 AM UTC+00  In response to the Reserve Bank of India's (RBI) recent restrictions on Paytm Payments Bank, Paytm CEO Vijay Shekhar Sharma has reassured users that the Paytm app will continue to operate normally beyond February 29. |

Friday 02 February 2024 08:08 AM UTC+00  Apple's revenue in India reached a record high in the December 2023 quarter, driven by robust sales of iPhones, according to Apple CEO Tim Cook. |

Friday 02 February 2024 09:14 AM UTC+00  The government expects the average monthly Goods and Services Tax (GST) collections to increase by 11 per cent to reach around Rs 1.85 lakh crore in the fiscal year 2024-25, compared to approximately Rs 1.66 lakh crore in the current fiscal year, according to Revenue Sanjay Malhotra. |

Saturday 03 February 2024 12:45 PM UTC+00  Paytm Payments Bank: Paytm Payments Bank: Money laundering concerns and questionable dealings of hundreds of crores of rupees between popular wallet Paytm and its lesser-known banking arm had led the Reserve Bank of India (RBI) to clamp down on tech poster boy Vijay Sekhar Sharma-run entities, sources said. |

Sunday 04 February 2024 06:21 AM UTC+00  State Bank of India (SBI) has come forward to help Paytm customers following a ban on the latter's activities by the Reserve Bank of India from March 1. SBI Chairman Dinesh Kumar Khara said, "If there is a direction from the RBI to any effect, we will rescue the once-storied Paytm." However, he said that the company has no plans of going directly into the matter addressing the media during the third quarter earnings. |

Friday 02 February 2024 04:15 AM UTC+00  Benchmark equity indices rebounded strongly in early trade on Friday, following a global market rally and increased buying in Reliance Industries and ICICI Bank. The 30-share BSE Sensex surged by 846.64 points to 72,491.94, while the Nifty rose by 256.55 points to 21,954. |

Friday 02 February 2024 04:38 AM UTC+00  Paytm CEO Vijay Shekhar Sharma reassured users on Friday, addressing concerns after the Reserve Bank of India (RBI) ordered its banking arm to cease accepting new deposits. |

Friday 02 February 2024 05:46 AM UTC+00  The income tax department has collected around Rs 4,600 crore in taxes from 56 lakh updated income tax returns filed by taxpayers in the past two years, according to Nitin Gupta, the Chief of the Central Board of Direct Taxes (CBDT). |

Friday 02 February 2024 06:48 AM UTC+00  In the late morning trading on Friday, the NSE Nifty surged to a record high by gaining 429 points and trading at 22,126.80, while the BSE Sensex rose by 1,444 points, reaching a day high of 73,089.40. |

Friday 02 February 2024 07:43 AM UTC+00  In response to the Reserve Bank of India's (RBI) recent restrictions on Paytm Payments Bank, Paytm CEO Vijay Shekhar Sharma has reassured users that the Paytm app will continue to operate normally beyond February 29. |

Friday 02 February 2024 08:08 AM UTC+00  Apple's revenue in India reached a record high in the December 2023 quarter, driven by robust sales of iPhones, according to Apple CEO Tim Cook. |

Friday 02 February 2024 09:14 AM UTC+00  The government expects the average monthly Goods and Services Tax (GST) collections to increase by 11 per cent to reach around Rs 1.85 lakh crore in the fiscal year 2024-25, compared to approximately Rs 1.66 lakh crore in the current fiscal year, according to Revenue Sanjay Malhotra. |

Saturday 03 February 2024 12:45 PM UTC+00  Paytm Payments Bank: Paytm Payments Bank: Money laundering concerns and questionable dealings of hundreds of crores of rupees between popular wallet Paytm and its lesser-known banking arm had led the Reserve Bank of India (RBI) to clamp down on tech poster boy Vijay Sekhar Sharma-run entities, sources said. |

Sunday 04 February 2024 06:21 AM UTC+00  State Bank of India (SBI) has come forward to help Paytm customers following a ban on the latter's activities by the Reserve Bank of India from March 1. SBI Chairman Dinesh Kumar Khara said, "If there is a direction from the RBI to any effect, we will rescue the once-storied Paytm." However, he said that the company has no plans of going directly into the matter addressing the media during the third quarter earnings. |

Sunday 04 February 2024 11:52 AM UTC+00  Paytm Payments Bank: Paytm Payments Bank: Traders' body CAIT today (February 4) issued a cautionary advisory to traders to switch from Paytm to other payment options for business-related transactions following RBI curbs on Paytm wallet and bank operations. |

Friday 02 February 2024 04:15 AM UTC+00  Benchmark equity indices rebounded strongly in early trade on Friday, following a global market rally and increased buying in Reliance Industries and ICICI Bank. The 30-share BSE Sensex surged by 846.64 points to 72,491.94, while the Nifty rose by 256.55 points to 21,954. |

Friday 02 February 2024 04:38 AM UTC+00  Paytm CEO Vijay Shekhar Sharma reassured users on Friday, addressing concerns after the Reserve Bank of India (RBI) ordered its banking arm to cease accepting new deposits. |

Friday 02 February 2024 05:46 AM UTC+00  The income tax department has collected around Rs 4,600 crore in taxes from 56 lakh updated income tax returns filed by taxpayers in the past two years, according to Nitin Gupta, the Chief of the Central Board of Direct Taxes (CBDT). |

Friday 02 February 2024 06:48 AM UTC+00  In the late morning trading on Friday, the NSE Nifty surged to a record high by gaining 429 points and trading at 22,126.80, while the BSE Sensex rose by 1,444 points, reaching a day high of 73,089.40. |

Friday 02 February 2024 07:43 AM UTC+00  In response to the Reserve Bank of India's (RBI) recent restrictions on Paytm Payments Bank, Paytm CEO Vijay Shekhar Sharma has reassured users that the Paytm app will continue to operate normally beyond February 29. |

Friday 02 February 2024 08:08 AM UTC+00  Apple's revenue in India reached a record high in the December 2023 quarter, driven by robust sales of iPhones, according to Apple CEO Tim Cook. |

Friday 02 February 2024 09:14 AM UTC+00  The government expects the average monthly Goods and Services Tax (GST) collections to increase by 11 per cent to reach around Rs 1.85 lakh crore in the fiscal year 2024-25, compared to approximately Rs 1.66 lakh crore in the current fiscal year, according to Revenue Sanjay Malhotra. |

Saturday 03 February 2024 12:45 PM UTC+00  Paytm Payments Bank: Paytm Payments Bank: Money laundering concerns and questionable dealings of hundreds of crores of rupees between popular wallet Paytm and its lesser-known banking arm had led the Reserve Bank of India (RBI) to clamp down on tech poster boy Vijay Sekhar Sharma-run entities, sources said. |

Sunday 04 February 2024 06:21 AM UTC+00  State Bank of India (SBI) has come forward to help Paytm customers following a ban on the latter's activities by the Reserve Bank of India from March 1. SBI Chairman Dinesh Kumar Khara said, "If there is a direction from the RBI to any effect, we will rescue the once-storied Paytm." However, he said that the company has no plans of going directly into the matter addressing the media during the third quarter earnings. |

Sunday 04 February 2024 11:52 AM UTC+00  Paytm Payments Bank: Paytm Payments Bank: Traders' body CAIT today (February 4) issued a cautionary advisory to traders to switch from Paytm to other payment options for business-related transactions following RBI curbs on Paytm wallet and bank operations. |

Friday 02 February 2024 04:15 AM UTC+00  Benchmark equity indices rebounded strongly in early trade on Friday, following a global market rally and increased buying in Reliance Industries and ICICI Bank. The 30-share BSE Sensex surged by 846.64 points to 72,491.94, while the Nifty rose by 256.55 points to 21,954. |

Friday 02 February 2024 04:38 AM UTC+00  Paytm CEO Vijay Shekhar Sharma reassured users on Friday, addressing concerns after the Reserve Bank of India (RBI) ordered its banking arm to cease accepting new deposits. |

Friday 02 February 2024 05:46 AM UTC+00  The income tax department has collected around Rs 4,600 crore in taxes from 56 lakh updated income tax returns filed by taxpayers in the past two years, according to Nitin Gupta, the Chief of the Central Board of Direct Taxes (CBDT). |

Friday 02 February 2024 06:48 AM UTC+00  In the late morning trading on Friday, the NSE Nifty surged to a record high by gaining 429 points and trading at 22,126.80, while the BSE Sensex rose by 1,444 points, reaching a day high of 73,089.40. |

Friday 02 February 2024 07:43 AM UTC+00  In response to the Reserve Bank of India's (RBI) recent restrictions on Paytm Payments Bank, Paytm CEO Vijay Shekhar Sharma has reassured users that the Paytm app will continue to operate normally beyond February 29. |

Friday 02 February 2024 08:08 AM UTC+00  Apple's revenue in India reached a record high in the December 2023 quarter, driven by robust sales of iPhones, according to Apple CEO Tim Cook. |

Friday 02 February 2024 09:14 AM UTC+00  The government expects the average monthly Goods and Services Tax (GST) collections to increase by 11 per cent to reach around Rs 1.85 lakh crore in the fiscal year 2024-25, compared to approximately Rs 1.66 lakh crore in the current fiscal year, according to Revenue Sanjay Malhotra. |

Saturday 03 February 2024 12:45 PM UTC+00  Paytm Payments Bank: Paytm Payments Bank: Money laundering concerns and questionable dealings of hundreds of crores of rupees between popular wallet Paytm and its lesser-known banking arm had led the Reserve Bank of India (RBI) to clamp down on tech poster boy Vijay Sekhar Sharma-run entities, sources said. |

Sunday 04 February 2024 06:21 AM UTC+00  State Bank of India (SBI) has come forward to help Paytm customers following a ban on the latter's activities by the Reserve Bank of India from March 1. SBI Chairman Dinesh Kumar Khara said, "If there is a direction from the RBI to any effect, we will rescue the once-storied Paytm." However, he said that the company has no plans of going directly into the matter addressing the media during the third quarter earnings. |

Sunday 04 February 2024 11:52 AM UTC+00  Paytm Payments Bank: Paytm Payments Bank: Traders' body CAIT today (February 4) issued a cautionary advisory to traders to switch from Paytm to other payment options for business-related transactions following RBI curbs on Paytm wallet and bank operations. |

| You received this email because you set up a subscription at Feedrabbit. This email was sent to you at epaperindia10@gmail.com. Unsubscribe or change your subscription. |