IndiaTV Business: Google News FeedIndiaTV: Business RSS Feed |

Table of Contents

|

Budget 2024: How the new tax regime announced by Sitharaman will impact taxpayers? Tuesday 23 July 2024 09:25 AM UTC+00  Budget 2024: Finance Minister Nirmala Sitharaman on Tuesday presented her seventh straight Budget for the fiscal 2024-25. Informing that the fiscal deficit is estimated at 4.9 per cent of GDP, Sitharaman said that the people have reposed their faith in the government led by PM Modi and re-elected it for the historic third term. Budget 2024: Finance Minister Nirmala Sitharaman on Tuesday presented her seventh straight Budget for the fiscal 2024-25. Informing that the fiscal deficit is estimated at 4.9 per cent of GDP, Sitharaman said that the people have reposed their faith in the government led by PM Modi and re-elected it for the historic third term. |

Union Budget 2024: 'Simplified taxation, revenue mobilisation in focus,' says Nirmala Sitharaman Tuesday 23 July 2024 10:06 AM UTC+00  Union Finance Minister Nirmala Sitharaman highlighted key aspects of the Union Budget 2024 in a press conference, emphasising a simplified approach to taxation. She stated, "We wanted to simplify the approach to taxation, also for the capital gains. Second, the average taxation has come down when we say it is 12.5%. We have worked out for each of the different asset classes...The point that we brought it down from below the average to 12.5% encourages market investment." Union Finance Minister Nirmala Sitharaman highlighted key aspects of the Union Budget 2024 in a press conference, emphasising a simplified approach to taxation. She stated, "We wanted to simplify the approach to taxation, also for the capital gains. Second, the average taxation has come down when we say it is 12.5%. We have worked out for each of the different asset classes...The point that we brought it down from below the average to 12.5% encourages market investment." |

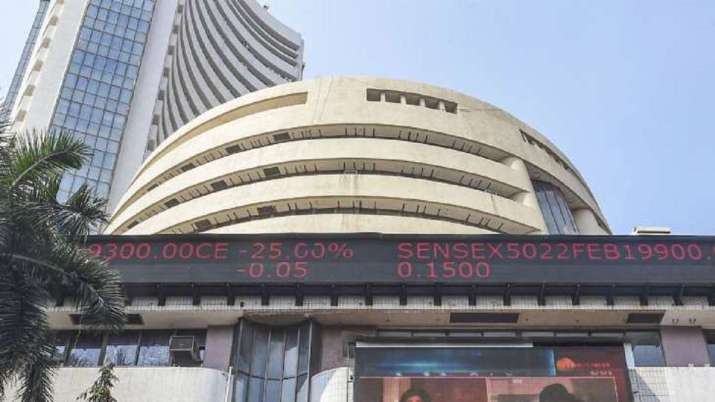

Nifty closes below 24,500, Sensex nears 80,400 amid volatile trade on Budget Day Tuesday 23 July 2024 11:20 AM UTC+00  Benchmark indices Sensex and Nifty closed slightly down on Tuesday after a volatile trading session driven by the announcement of the Union Budget for 2024–25. The government proposed to hike the securities transaction tax (STT) on futures and options (F&O) trading, causing initial market jitters. The BSE Sensex recovered most of its over 1,200-point intra-day loss, closing down by 73.04 points or 0.09%, at 80,429.04. It hit a low of 79,224.32 after the finance minister's announcement. The NSE Nifty also dipped, ending 30.20 points or 0.12% lower at 24,479.05, after dropping to 24,074.20 during the day. Benchmark indices Sensex and Nifty closed slightly down on Tuesday after a volatile trading session driven by the announcement of the Union Budget for 2024–25. The government proposed to hike the securities transaction tax (STT) on futures and options (F&O) trading, causing initial market jitters. The BSE Sensex recovered most of its over 1,200-point intra-day loss, closing down by 73.04 points or 0.09%, at 80,429.04. It hit a low of 79,224.32 after the finance minister's announcement. The NSE Nifty also dipped, ending 30.20 points or 0.12% lower at 24,479.05, after dropping to 24,074.20 during the day. |

Budget 2024: Sitharaman allocates Rs 3 lakh crore for women and girls development schemes Tuesday 23 July 2024 11:39 AM UTC+00 |

Budget 2024: 'Can't say if there will be a sunset', says Nirmala Sitharaman on old tax regime Tuesday 23 July 2024 12:41 PM UTC+00  Finance Minister Nirmala Sitharaman presented the first Budget of the Modi 3.0 government, introducing significant changes to the income tax structure. Notably, she revised tax slabs and increased the standard deduction limit under the New Tax Regime. However, the Old Tax Regime remains unchanged. After presenting the 2024 Union Budget in Parliament, she said, "Can't take a call on whether the old tax regime will be done away with. Can only say the intention is to make the tax regime simpler. Can't say if there will be a sunset on the old regime." Finance Minister Nirmala Sitharaman presented the first Budget of the Modi 3.0 government, introducing significant changes to the income tax structure. Notably, she revised tax slabs and increased the standard deduction limit under the New Tax Regime. However, the Old Tax Regime remains unchanged. After presenting the 2024 Union Budget in Parliament, she said, "Can't take a call on whether the old tax regime will be done away with. Can only say the intention is to make the tax regime simpler. Can't say if there will be a sunset on the old regime." |

Railway Budget 2024: Govt proposes hike in net revenue expenditure, Vande Bharat trains to remain focus Tuesday 23 July 2024 01:34 PM UTC+00  Railway Budget 2024: Union Finance Minister Nirmala Sitharaman did not make any major announcements for the railways. However, the government increased the net revenue expenditure of the Indian Railways by Rs 20 crore to Rs 2,78,500 crore for 2024-25, compared to Rs 2,58,600 crore in the Revised Estimate for 2023-24. Railway Budget 2024: Union Finance Minister Nirmala Sitharaman did not make any major announcements for the railways. However, the government increased the net revenue expenditure of the Indian Railways by Rs 20 crore to Rs 2,78,500 crore for 2024-25, compared to Rs 2,58,600 crore in the Revised Estimate for 2023-24. |

Budget 2024: What's for youth in Sitharaman's announcement? HR, Ed-tech industry experts explain Tuesday 23 July 2024 01:40 PM UTC+00  Finance Minister Nirmala Sitharaman, who on Tuesday presented the Budget for 2024-25, her 7th straight presentation surpassing the record of former pime minister Morarji Desai, got thumbs-up from HR and Ed-tech industry experts. They said the budget proposals on skilling, internship and job creation will help address the need for a skilled workforce and boost employment generation for youth. Finance Minister Nirmala Sitharaman, who on Tuesday presented the Budget for 2024-25, her 7th straight presentation surpassing the record of former pime minister Morarji Desai, got thumbs-up from HR and Ed-tech industry experts. They said the budget proposals on skilling, internship and job creation will help address the need for a skilled workforce and boost employment generation for youth. |

Budget 2024 | Old or new tax regime: Which will be more beneficial for you? Know here Wednesday 24 July 2024 02:23 AM UTC+00  Budget 2024: In the Budget, Finance Minister Nirmala Sitharaman did not make any changes in the old tax regime but increased the exemption limit in the new tax regime, making it more advantageous than before. Following the announcements made by the Finance Minister in Budget 2024, taxpayers are now uncertain about which regime to choose. If you are also a taxpayer, we will explain all the calculations to help you decide. Here's a detailed breakdown to help you understand which regime might be more beneficial for you. Budget 2024: In the Budget, Finance Minister Nirmala Sitharaman did not make any changes in the old tax regime but increased the exemption limit in the new tax regime, making it more advantageous than before. Following the announcements made by the Finance Minister in Budget 2024, taxpayers are now uncertain about which regime to choose. If you are also a taxpayer, we will explain all the calculations to help you decide. Here's a detailed breakdown to help you understand which regime might be more beneficial for you. |

Stock markets: Sensex tanks 117 points, Nifty down to 24,443 day after budget presentation Wednesday 24 July 2024 04:20 AM UTC+00  Stock markets update: The recent budget announcement to increase the short-term capital gains tax on share sales from 15 per cent to 20 per cent and the long-term capital gains tax from 10 per cent to 12.5 per cent is still evident in the stock market today. After closing in the red on budget day, the market opened weak again on Wednesday. Stock markets update: The recent budget announcement to increase the short-term capital gains tax on share sales from 15 per cent to 20 per cent and the long-term capital gains tax from 10 per cent to 12.5 per cent is still evident in the stock market today. After closing in the red on budget day, the market opened weak again on Wednesday. |

Market update: Sensex falls by 280 points, Nifty experiences decline Wednesday 24 July 2024 10:24 AM UTC+00  Extending its losing streak to the fourth day, the benchmark BSE Sensex declined by 280.16 points on Wednesday, closing at 80,148.88. This drop, amounting to a 0.35% decrease, was driven by profit booking in financial and banking shares following the government's announcement of a hike in securities transaction tax and short-term capital gains tax in the budget for 2024-25. Extending its losing streak to the fourth day, the benchmark BSE Sensex declined by 280.16 points on Wednesday, closing at 80,148.88. This drop, amounting to a 0.35% decrease, was driven by profit booking in financial and banking shares following the government's announcement of a hike in securities transaction tax and short-term capital gains tax in the budget for 2024-25. |

Nifty closes below 24,500, Sensex nears 80,400 amid volatile trade on Budget Day Tuesday 23 July 2024 11:20 AM UTC+00  Benchmark indices Sensex and Nifty closed slightly down on Tuesday after a volatile trading session driven by the announcement of the Union Budget for 2024–25. The government proposed to hike the securities transaction tax (STT) on futures and options (F&O) trading, causing initial market jitters. The BSE Sensex recovered most of its over 1,200-point intra-day loss, closing down by 73.04 points or 0.09%, at 80,429.04. It hit a low of 79,224.32 after the finance minister's announcement. The NSE Nifty also dipped, ending 30.20 points or 0.12% lower at 24,479.05, after dropping to 24,074.20 during the day. Benchmark indices Sensex and Nifty closed slightly down on Tuesday after a volatile trading session driven by the announcement of the Union Budget for 2024–25. The government proposed to hike the securities transaction tax (STT) on futures and options (F&O) trading, causing initial market jitters. The BSE Sensex recovered most of its over 1,200-point intra-day loss, closing down by 73.04 points or 0.09%, at 80,429.04. It hit a low of 79,224.32 after the finance minister's announcement. The NSE Nifty also dipped, ending 30.20 points or 0.12% lower at 24,479.05, after dropping to 24,074.20 during the day. |

Budget 2024: Sitharaman allocates Rs 3 lakh crore for women and girls development schemes Tuesday 23 July 2024 11:39 AM UTC+00 |

Budget 2024: 'Can't say if there will be a sunset', says Nirmala Sitharaman on old tax regime Tuesday 23 July 2024 12:41 PM UTC+00  Finance Minister Nirmala Sitharaman presented the first Budget of the Modi 3.0 government, introducing significant changes to the income tax structure. Notably, she revised tax slabs and increased the standard deduction limit under the New Tax Regime. However, the Old Tax Regime remains unchanged. After presenting the 2024 Union Budget in Parliament, she said, "Can't take a call on whether the old tax regime will be done away with. Can only say the intention is to make the tax regime simpler. Can't say if there will be a sunset on the old regime." Finance Minister Nirmala Sitharaman presented the first Budget of the Modi 3.0 government, introducing significant changes to the income tax structure. Notably, she revised tax slabs and increased the standard deduction limit under the New Tax Regime. However, the Old Tax Regime remains unchanged. After presenting the 2024 Union Budget in Parliament, she said, "Can't take a call on whether the old tax regime will be done away with. Can only say the intention is to make the tax regime simpler. Can't say if there will be a sunset on the old regime." |

Railway Budget 2024: Govt proposes hike in net revenue expenditure, Vande Bharat trains to remain focus Tuesday 23 July 2024 01:34 PM UTC+00  Railway Budget 2024: Union Finance Minister Nirmala Sitharaman did not make any major announcements for the railways. However, the government increased the net revenue expenditure of the Indian Railways by Rs 20 crore to Rs 2,78,500 crore for 2024-25, compared to Rs 2,58,600 crore in the Revised Estimate for 2023-24. Railway Budget 2024: Union Finance Minister Nirmala Sitharaman did not make any major announcements for the railways. However, the government increased the net revenue expenditure of the Indian Railways by Rs 20 crore to Rs 2,78,500 crore for 2024-25, compared to Rs 2,58,600 crore in the Revised Estimate for 2023-24. |

Budget 2024: What's for youth in Sitharaman's announcement? HR, Ed-tech industry experts explain Tuesday 23 July 2024 01:40 PM UTC+00  Finance Minister Nirmala Sitharaman, who on Tuesday presented the Budget for 2024-25, her 7th straight presentation surpassing the record of former pime minister Morarji Desai, got thumbs-up from HR and Ed-tech industry experts. They said the budget proposals on skilling, internship and job creation will help address the need for a skilled workforce and boost employment generation for youth. Finance Minister Nirmala Sitharaman, who on Tuesday presented the Budget for 2024-25, her 7th straight presentation surpassing the record of former pime minister Morarji Desai, got thumbs-up from HR and Ed-tech industry experts. They said the budget proposals on skilling, internship and job creation will help address the need for a skilled workforce and boost employment generation for youth. |

Budget 2024 | Old or new tax regime: Which will be more beneficial for you? Know here Wednesday 24 July 2024 02:23 AM UTC+00  Budget 2024: In the Budget, Finance Minister Nirmala Sitharaman did not make any changes in the old tax regime but increased the exemption limit in the new tax regime, making it more advantageous than before. Following the announcements made by the Finance Minister in Budget 2024, taxpayers are now uncertain about which regime to choose. If you are also a taxpayer, we will explain all the calculations to help you decide. Here's a detailed breakdown to help you understand which regime might be more beneficial for you. Budget 2024: In the Budget, Finance Minister Nirmala Sitharaman did not make any changes in the old tax regime but increased the exemption limit in the new tax regime, making it more advantageous than before. Following the announcements made by the Finance Minister in Budget 2024, taxpayers are now uncertain about which regime to choose. If you are also a taxpayer, we will explain all the calculations to help you decide. Here's a detailed breakdown to help you understand which regime might be more beneficial for you. |

Stock markets: Sensex tanks 117 points, Nifty down to 24,443 day after budget presentation Wednesday 24 July 2024 04:20 AM UTC+00  Stock markets update: The recent budget announcement to increase the short-term capital gains tax on share sales from 15 per cent to 20 per cent and the long-term capital gains tax from 10 per cent to 12.5 per cent is still evident in the stock market today. After closing in the red on budget day, the market opened weak again on Wednesday. Stock markets update: The recent budget announcement to increase the short-term capital gains tax on share sales from 15 per cent to 20 per cent and the long-term capital gains tax from 10 per cent to 12.5 per cent is still evident in the stock market today. After closing in the red on budget day, the market opened weak again on Wednesday. |

Market update: Sensex falls by 280 points, Nifty experiences decline Wednesday 24 July 2024 10:24 AM UTC+00  Extending its losing streak to the fourth day, the benchmark BSE Sensex declined by 280.16 points on Wednesday, closing at 80,148.88. This drop, amounting to a 0.35% decrease, was driven by profit booking in financial and banking shares following the government's announcement of a hike in securities transaction tax and short-term capital gains tax in the budget for 2024-25. Extending its losing streak to the fourth day, the benchmark BSE Sensex declined by 280.16 points on Wednesday, closing at 80,148.88. This drop, amounting to a 0.35% decrease, was driven by profit booking in financial and banking shares following the government's announcement of a hike in securities transaction tax and short-term capital gains tax in the budget for 2024-25. |

Stock markets open in red as Sensex tumbles over 670 points, Nifty declines 203 points to 24,210 Thursday 25 July 2024 04:13 AM UTC+00  Stock markets opened in red on the second consecutive day after the presentation of the Union Budget on July 23. The equity benchmark indices declined in early trade on Thursday amid weak global cues and unabated foreign fund outflows. The 30-share BSE Sensex fell 671 points to 79,477.83. Meanwhile, the Nifty declined 202.7 points to 24,210.80 points. Stock markets opened in red on the second consecutive day after the presentation of the Union Budget on July 23. The equity benchmark indices declined in early trade on Thursday amid weak global cues and unabated foreign fund outflows. The 30-share BSE Sensex fell 671 points to 79,477.83. Meanwhile, the Nifty declined 202.7 points to 24,210.80 points. |

RBI tightens norms for cash pay-outs at banks | Check new rules Thursday 25 July 2024 04:49 AM UTC+00 |

Nifty closes below 24,500, Sensex nears 80,400 amid volatile trade on Budget Day Tuesday 23 July 2024 11:20 AM UTC+00  Benchmark indices Sensex and Nifty closed slightly down on Tuesday after a volatile trading session driven by the announcement of the Union Budget for 2024–25. The government proposed to hike the securities transaction tax (STT) on futures and options (F&O) trading, causing initial market jitters. The BSE Sensex recovered most of its over 1,200-point intra-day loss, closing down by 73.04 points or 0.09%, at 80,429.04. It hit a low of 79,224.32 after the finance minister's announcement. The NSE Nifty also dipped, ending 30.20 points or 0.12% lower at 24,479.05, after dropping to 24,074.20 during the day. Benchmark indices Sensex and Nifty closed slightly down on Tuesday after a volatile trading session driven by the announcement of the Union Budget for 2024–25. The government proposed to hike the securities transaction tax (STT) on futures and options (F&O) trading, causing initial market jitters. The BSE Sensex recovered most of its over 1,200-point intra-day loss, closing down by 73.04 points or 0.09%, at 80,429.04. It hit a low of 79,224.32 after the finance minister's announcement. The NSE Nifty also dipped, ending 30.20 points or 0.12% lower at 24,479.05, after dropping to 24,074.20 during the day. |

Budget 2024: Sitharaman allocates Rs 3 lakh crore for women and girls development schemes Tuesday 23 July 2024 11:39 AM UTC+00 |

Budget 2024: 'Can't say if there will be a sunset', says Nirmala Sitharaman on old tax regime Tuesday 23 July 2024 12:41 PM UTC+00  Finance Minister Nirmala Sitharaman presented the first Budget of the Modi 3.0 government, introducing significant changes to the income tax structure. Notably, she revised tax slabs and increased the standard deduction limit under the New Tax Regime. However, the Old Tax Regime remains unchanged. After presenting the 2024 Union Budget in Parliament, she said, "Can't take a call on whether the old tax regime will be done away with. Can only say the intention is to make the tax regime simpler. Can't say if there will be a sunset on the old regime." Finance Minister Nirmala Sitharaman presented the first Budget of the Modi 3.0 government, introducing significant changes to the income tax structure. Notably, she revised tax slabs and increased the standard deduction limit under the New Tax Regime. However, the Old Tax Regime remains unchanged. After presenting the 2024 Union Budget in Parliament, she said, "Can't take a call on whether the old tax regime will be done away with. Can only say the intention is to make the tax regime simpler. Can't say if there will be a sunset on the old regime." |

Railway Budget 2024: Govt proposes hike in net revenue expenditure, Vande Bharat trains to remain focus Tuesday 23 July 2024 01:34 PM UTC+00  Railway Budget 2024: Union Finance Minister Nirmala Sitharaman did not make any major announcements for the railways. However, the government increased the net revenue expenditure of the Indian Railways by Rs 20 crore to Rs 2,78,500 crore for 2024-25, compared to Rs 2,58,600 crore in the Revised Estimate for 2023-24. Railway Budget 2024: Union Finance Minister Nirmala Sitharaman did not make any major announcements for the railways. However, the government increased the net revenue expenditure of the Indian Railways by Rs 20 crore to Rs 2,78,500 crore for 2024-25, compared to Rs 2,58,600 crore in the Revised Estimate for 2023-24. |

Budget 2024: What's for youth in Sitharaman's announcement? HR, Ed-tech industry experts explain Tuesday 23 July 2024 01:40 PM UTC+00  Finance Minister Nirmala Sitharaman, who on Tuesday presented the Budget for 2024-25, her 7th straight presentation surpassing the record of former pime minister Morarji Desai, got thumbs-up from HR and Ed-tech industry experts. They said the budget proposals on skilling, internship and job creation will help address the need for a skilled workforce and boost employment generation for youth. Finance Minister Nirmala Sitharaman, who on Tuesday presented the Budget for 2024-25, her 7th straight presentation surpassing the record of former pime minister Morarji Desai, got thumbs-up from HR and Ed-tech industry experts. They said the budget proposals on skilling, internship and job creation will help address the need for a skilled workforce and boost employment generation for youth. |

Budget 2024 | Old or new tax regime: Which will be more beneficial for you? Know here Wednesday 24 July 2024 02:23 AM UTC+00  Budget 2024: In the Budget, Finance Minister Nirmala Sitharaman did not make any changes in the old tax regime but increased the exemption limit in the new tax regime, making it more advantageous than before. Following the announcements made by the Finance Minister in Budget 2024, taxpayers are now uncertain about which regime to choose. If you are also a taxpayer, we will explain all the calculations to help you decide. Here's a detailed breakdown to help you understand which regime might be more beneficial for you. Budget 2024: In the Budget, Finance Minister Nirmala Sitharaman did not make any changes in the old tax regime but increased the exemption limit in the new tax regime, making it more advantageous than before. Following the announcements made by the Finance Minister in Budget 2024, taxpayers are now uncertain about which regime to choose. If you are also a taxpayer, we will explain all the calculations to help you decide. Here's a detailed breakdown to help you understand which regime might be more beneficial for you. |

Stock markets: Sensex tanks 117 points, Nifty down to 24,443 day after budget presentation Wednesday 24 July 2024 04:20 AM UTC+00  Stock markets update: The recent budget announcement to increase the short-term capital gains tax on share sales from 15 per cent to 20 per cent and the long-term capital gains tax from 10 per cent to 12.5 per cent is still evident in the stock market today. After closing in the red on budget day, the market opened weak again on Wednesday. Stock markets update: The recent budget announcement to increase the short-term capital gains tax on share sales from 15 per cent to 20 per cent and the long-term capital gains tax from 10 per cent to 12.5 per cent is still evident in the stock market today. After closing in the red on budget day, the market opened weak again on Wednesday. |

Market update: Sensex falls by 280 points, Nifty experiences decline Wednesday 24 July 2024 10:24 AM UTC+00  Extending its losing streak to the fourth day, the benchmark BSE Sensex declined by 280.16 points on Wednesday, closing at 80,148.88. This drop, amounting to a 0.35% decrease, was driven by profit booking in financial and banking shares following the government's announcement of a hike in securities transaction tax and short-term capital gains tax in the budget for 2024-25. Extending its losing streak to the fourth day, the benchmark BSE Sensex declined by 280.16 points on Wednesday, closing at 80,148.88. This drop, amounting to a 0.35% decrease, was driven by profit booking in financial and banking shares following the government's announcement of a hike in securities transaction tax and short-term capital gains tax in the budget for 2024-25. |

Stock markets open in red as Sensex tumbles over 670 points, Nifty declines 203 points to 24,210 Thursday 25 July 2024 04:13 AM UTC+00  Stock markets opened in red on the second consecutive day after the presentation of the Union Budget on July 23. The equity benchmark indices declined in early trade on Thursday amid weak global cues and unabated foreign fund outflows. The 30-share BSE Sensex fell 671 points to 79,477.83. Meanwhile, the Nifty declined 202.7 points to 24,210.80 points. Stock markets opened in red on the second consecutive day after the presentation of the Union Budget on July 23. The equity benchmark indices declined in early trade on Thursday amid weak global cues and unabated foreign fund outflows. The 30-share BSE Sensex fell 671 points to 79,477.83. Meanwhile, the Nifty declined 202.7 points to 24,210.80 points. |

RBI tightens norms for cash pay-outs at banks | Check new rules Thursday 25 July 2024 04:49 AM UTC+00 |

Budget 2024: Sitharaman allocates Rs 3 lakh crore for women and girls development schemes Tuesday 23 July 2024 11:39 AM UTC+00 |

Budget 2024: 'Can't say if there will be a sunset', says Nirmala Sitharaman on old tax regime Tuesday 23 July 2024 12:41 PM UTC+00  Finance Minister Nirmala Sitharaman presented the first Budget of the Modi 3.0 government, introducing significant changes to the income tax structure. Notably, she revised tax slabs and increased the standard deduction limit under the New Tax Regime. However, the Old Tax Regime remains unchanged. After presenting the 2024 Union Budget in Parliament, she said, "Can't take a call on whether the old tax regime will be done away with. Can only say the intention is to make the tax regime simpler. Can't say if there will be a sunset on the old regime." Finance Minister Nirmala Sitharaman presented the first Budget of the Modi 3.0 government, introducing significant changes to the income tax structure. Notably, she revised tax slabs and increased the standard deduction limit under the New Tax Regime. However, the Old Tax Regime remains unchanged. After presenting the 2024 Union Budget in Parliament, she said, "Can't take a call on whether the old tax regime will be done away with. Can only say the intention is to make the tax regime simpler. Can't say if there will be a sunset on the old regime." |

Railway Budget 2024: Govt proposes hike in net revenue expenditure, Vande Bharat trains to remain focus Tuesday 23 July 2024 01:34 PM UTC+00  Railway Budget 2024: Union Finance Minister Nirmala Sitharaman did not make any major announcements for the railways. However, the government increased the net revenue expenditure of the Indian Railways by Rs 20 crore to Rs 2,78,500 crore for 2024-25, compared to Rs 2,58,600 crore in the Revised Estimate for 2023-24. Railway Budget 2024: Union Finance Minister Nirmala Sitharaman did not make any major announcements for the railways. However, the government increased the net revenue expenditure of the Indian Railways by Rs 20 crore to Rs 2,78,500 crore for 2024-25, compared to Rs 2,58,600 crore in the Revised Estimate for 2023-24. |

Budget 2024: What's for youth in Sitharaman's announcement? HR, Ed-tech industry experts explain Tuesday 23 July 2024 01:40 PM UTC+00  Finance Minister Nirmala Sitharaman, who on Tuesday presented the Budget for 2024-25, her 7th straight presentation surpassing the record of former pime minister Morarji Desai, got thumbs-up from HR and Ed-tech industry experts. They said the budget proposals on skilling, internship and job creation will help address the need for a skilled workforce and boost employment generation for youth. Finance Minister Nirmala Sitharaman, who on Tuesday presented the Budget for 2024-25, her 7th straight presentation surpassing the record of former pime minister Morarji Desai, got thumbs-up from HR and Ed-tech industry experts. They said the budget proposals on skilling, internship and job creation will help address the need for a skilled workforce and boost employment generation for youth. |

Budget 2024 | Old or new tax regime: Which will be more beneficial for you? Know here Wednesday 24 July 2024 02:23 AM UTC+00  Budget 2024: In the Budget, Finance Minister Nirmala Sitharaman did not make any changes in the old tax regime but increased the exemption limit in the new tax regime, making it more advantageous than before. Following the announcements made by the Finance Minister in Budget 2024, taxpayers are now uncertain about which regime to choose. If you are also a taxpayer, we will explain all the calculations to help you decide. Here's a detailed breakdown to help you understand which regime might be more beneficial for you. Budget 2024: In the Budget, Finance Minister Nirmala Sitharaman did not make any changes in the old tax regime but increased the exemption limit in the new tax regime, making it more advantageous than before. Following the announcements made by the Finance Minister in Budget 2024, taxpayers are now uncertain about which regime to choose. If you are also a taxpayer, we will explain all the calculations to help you decide. Here's a detailed breakdown to help you understand which regime might be more beneficial for you. |

Stock markets: Sensex tanks 117 points, Nifty down to 24,443 day after budget presentation Wednesday 24 July 2024 04:20 AM UTC+00  Stock markets update: The recent budget announcement to increase the short-term capital gains tax on share sales from 15 per cent to 20 per cent and the long-term capital gains tax from 10 per cent to 12.5 per cent is still evident in the stock market today. After closing in the red on budget day, the market opened weak again on Wednesday. Stock markets update: The recent budget announcement to increase the short-term capital gains tax on share sales from 15 per cent to 20 per cent and the long-term capital gains tax from 10 per cent to 12.5 per cent is still evident in the stock market today. After closing in the red on budget day, the market opened weak again on Wednesday. |

Market update: Sensex falls by 280 points, Nifty experiences decline Wednesday 24 July 2024 10:24 AM UTC+00  Extending its losing streak to the fourth day, the benchmark BSE Sensex declined by 280.16 points on Wednesday, closing at 80,148.88. This drop, amounting to a 0.35% decrease, was driven by profit booking in financial and banking shares following the government's announcement of a hike in securities transaction tax and short-term capital gains tax in the budget for 2024-25. Extending its losing streak to the fourth day, the benchmark BSE Sensex declined by 280.16 points on Wednesday, closing at 80,148.88. This drop, amounting to a 0.35% decrease, was driven by profit booking in financial and banking shares following the government's announcement of a hike in securities transaction tax and short-term capital gains tax in the budget for 2024-25. |

Stock markets open in red as Sensex tumbles over 670 points, Nifty declines 203 points to 24,210 Thursday 25 July 2024 04:13 AM UTC+00  Stock markets opened in red on the second consecutive day after the presentation of the Union Budget on July 23. The equity benchmark indices declined in early trade on Thursday amid weak global cues and unabated foreign fund outflows. The 30-share BSE Sensex fell 671 points to 79,477.83. Meanwhile, the Nifty declined 202.7 points to 24,210.80 points. Stock markets opened in red on the second consecutive day after the presentation of the Union Budget on July 23. The equity benchmark indices declined in early trade on Thursday amid weak global cues and unabated foreign fund outflows. The 30-share BSE Sensex fell 671 points to 79,477.83. Meanwhile, the Nifty declined 202.7 points to 24,210.80 points. |

RBI tightens norms for cash pay-outs at banks | Check new rules Thursday 25 July 2024 04:49 AM UTC+00 |

SEBI updates Demat account rules: Know about increased investment limits, reduced charges Thursday 25 July 2024 12:36 PM UTC+00  The Securities and Exchange Board of India (SEBI) has announced an increase in the threshold for Basic Services Demat Accounts (BSDA) from Rs 2 lakh to Rs 10 lakh. Effective from September 1, 2024, investors can hold securities worth up to Rs 10 lakh in their BSDA. Introduced by SEBI in 2012, BSDA is designed to reduce the cost of holding securities for small investors by offering lower charges compared to regular Demat accounts. The Securities and Exchange Board of India (SEBI) has announced an increase in the threshold for Basic Services Demat Accounts (BSDA) from Rs 2 lakh to Rs 10 lakh. Effective from September 1, 2024, investors can hold securities worth up to Rs 10 lakh in their BSDA. Introduced by SEBI in 2012, BSDA is designed to reduce the cost of holding securities for small investors by offering lower charges compared to regular Demat accounts. |

Budget 2024: Sitharaman allocates Rs 3 lakh crore for women and girls development schemes Tuesday 23 July 2024 11:39 AM UTC+00 |

Budget 2024: 'Can't say if there will be a sunset', says Nirmala Sitharaman on old tax regime Tuesday 23 July 2024 12:41 PM UTC+00  Finance Minister Nirmala Sitharaman presented the first Budget of the Modi 3.0 government, introducing significant changes to the income tax structure. Notably, she revised tax slabs and increased the standard deduction limit under the New Tax Regime. However, the Old Tax Regime remains unchanged. After presenting the 2024 Union Budget in Parliament, she said, "Can't take a call on whether the old tax regime will be done away with. Can only say the intention is to make the tax regime simpler. Can't say if there will be a sunset on the old regime." Finance Minister Nirmala Sitharaman presented the first Budget of the Modi 3.0 government, introducing significant changes to the income tax structure. Notably, she revised tax slabs and increased the standard deduction limit under the New Tax Regime. However, the Old Tax Regime remains unchanged. After presenting the 2024 Union Budget in Parliament, she said, "Can't take a call on whether the old tax regime will be done away with. Can only say the intention is to make the tax regime simpler. Can't say if there will be a sunset on the old regime." |

Railway Budget 2024: Govt proposes hike in net revenue expenditure, Vande Bharat trains to remain focus Tuesday 23 July 2024 01:34 PM UTC+00  Railway Budget 2024: Union Finance Minister Nirmala Sitharaman did not make any major announcements for the railways. However, the government increased the net revenue expenditure of the Indian Railways by Rs 20 crore to Rs 2,78,500 crore for 2024-25, compared to Rs 2,58,600 crore in the Revised Estimate for 2023-24. Railway Budget 2024: Union Finance Minister Nirmala Sitharaman did not make any major announcements for the railways. However, the government increased the net revenue expenditure of the Indian Railways by Rs 20 crore to Rs 2,78,500 crore for 2024-25, compared to Rs 2,58,600 crore in the Revised Estimate for 2023-24. |

Budget 2024: What's for youth in Sitharaman's announcement? HR, Ed-tech industry experts explain Tuesday 23 July 2024 01:40 PM UTC+00  Finance Minister Nirmala Sitharaman, who on Tuesday presented the Budget for 2024-25, her 7th straight presentation surpassing the record of former pime minister Morarji Desai, got thumbs-up from HR and Ed-tech industry experts. They said the budget proposals on skilling, internship and job creation will help address the need for a skilled workforce and boost employment generation for youth. Finance Minister Nirmala Sitharaman, who on Tuesday presented the Budget for 2024-25, her 7th straight presentation surpassing the record of former pime minister Morarji Desai, got thumbs-up from HR and Ed-tech industry experts. They said the budget proposals on skilling, internship and job creation will help address the need for a skilled workforce and boost employment generation for youth. |

Budget 2024 | Old or new tax regime: Which will be more beneficial for you? Know here Wednesday 24 July 2024 02:23 AM UTC+00  Budget 2024: In the Budget, Finance Minister Nirmala Sitharaman did not make any changes in the old tax regime but increased the exemption limit in the new tax regime, making it more advantageous than before. Following the announcements made by the Finance Minister in Budget 2024, taxpayers are now uncertain about which regime to choose. If you are also a taxpayer, we will explain all the calculations to help you decide. Here's a detailed breakdown to help you understand which regime might be more beneficial for you. Budget 2024: In the Budget, Finance Minister Nirmala Sitharaman did not make any changes in the old tax regime but increased the exemption limit in the new tax regime, making it more advantageous than before. Following the announcements made by the Finance Minister in Budget 2024, taxpayers are now uncertain about which regime to choose. If you are also a taxpayer, we will explain all the calculations to help you decide. Here's a detailed breakdown to help you understand which regime might be more beneficial for you. |

Stock markets: Sensex tanks 117 points, Nifty down to 24,443 day after budget presentation Wednesday 24 July 2024 04:20 AM UTC+00  Stock markets update: The recent budget announcement to increase the short-term capital gains tax on share sales from 15 per cent to 20 per cent and the long-term capital gains tax from 10 per cent to 12.5 per cent is still evident in the stock market today. After closing in the red on budget day, the market opened weak again on Wednesday. Stock markets update: The recent budget announcement to increase the short-term capital gains tax on share sales from 15 per cent to 20 per cent and the long-term capital gains tax from 10 per cent to 12.5 per cent is still evident in the stock market today. After closing in the red on budget day, the market opened weak again on Wednesday. |

Market update: Sensex falls by 280 points, Nifty experiences decline Wednesday 24 July 2024 10:24 AM UTC+00  Extending its losing streak to the fourth day, the benchmark BSE Sensex declined by 280.16 points on Wednesday, closing at 80,148.88. This drop, amounting to a 0.35% decrease, was driven by profit booking in financial and banking shares following the government's announcement of a hike in securities transaction tax and short-term capital gains tax in the budget for 2024-25. Extending its losing streak to the fourth day, the benchmark BSE Sensex declined by 280.16 points on Wednesday, closing at 80,148.88. This drop, amounting to a 0.35% decrease, was driven by profit booking in financial and banking shares following the government's announcement of a hike in securities transaction tax and short-term capital gains tax in the budget for 2024-25. |

Stock markets open in red as Sensex tumbles over 670 points, Nifty declines 203 points to 24,210 Thursday 25 July 2024 04:13 AM UTC+00  Stock markets opened in red on the second consecutive day after the presentation of the Union Budget on July 23. The equity benchmark indices declined in early trade on Thursday amid weak global cues and unabated foreign fund outflows. The 30-share BSE Sensex fell 671 points to 79,477.83. Meanwhile, the Nifty declined 202.7 points to 24,210.80 points. Stock markets opened in red on the second consecutive day after the presentation of the Union Budget on July 23. The equity benchmark indices declined in early trade on Thursday amid weak global cues and unabated foreign fund outflows. The 30-share BSE Sensex fell 671 points to 79,477.83. Meanwhile, the Nifty declined 202.7 points to 24,210.80 points. |

RBI tightens norms for cash pay-outs at banks | Check new rules Thursday 25 July 2024 04:49 AM UTC+00 |

SEBI updates Demat account rules: Know about increased investment limits, reduced charges Thursday 25 July 2024 12:36 PM UTC+00  The Securities and Exchange Board of India (SEBI) has announced an increase in the threshold for Basic Services Demat Accounts (BSDA) from Rs 2 lakh to Rs 10 lakh. Effective from September 1, 2024, investors can hold securities worth up to Rs 10 lakh in their BSDA. Introduced by SEBI in 2012, BSDA is designed to reduce the cost of holding securities for small investors by offering lower charges compared to regular Demat accounts. The Securities and Exchange Board of India (SEBI) has announced an increase in the threshold for Basic Services Demat Accounts (BSDA) from Rs 2 lakh to Rs 10 lakh. Effective from September 1, 2024, investors can hold securities worth up to Rs 10 lakh in their BSDA. Introduced by SEBI in 2012, BSDA is designed to reduce the cost of holding securities for small investors by offering lower charges compared to regular Demat accounts. |

| You received this email because you set up a subscription at Feedrabbit. This email was sent to you at epaperindia10@gmail.com. Unsubscribe or change your subscription. |

Ad Unit (Iklan) BIG

Home

› Uncategorized

Related Posts

There is no other posts in this category.Recent

Loading...

Choose Hit Lists Category

- 365hindi

- actors

- actresses

- affidavits

- afghanistan

- akshaykumar

- apt

- asianmodels

- audi

- autos

- ba

- bba

- bevents

- bhaktigaane

- billboard

- bing

- birthdaywishes

- blog

- blugaa

- bm

- bollywood

- bollywoodhd

- budget

- cbse

- cbsenic

- celb

- celebritycars

- celebrityinsider

- chart

- cinema

- cricbuzz

- dailypost

- documentary

- drunkenstepfather

- education

- egotasticsports

- elections

- events

- evilbeetgossip

- fashion101

- festivals

- filmyquotes

- filthy

- free

- gazeis

- glambase

- glamgossip

- gold

- gossips

- gulte

- hd

- hdgallery

- health

- hindi

- hindi18

- hindibhajan

- hindinews18

- hindisamay

- hindisongs

- horoscope

- horror

- hsongs

- htracks

- icelebritieshub

- ifsc

- indiaresults

- indiatv

- info

- insta

- jobs

- kabaddi

- karnataka

- kashmir

- kkpop

- lallantop

- letters

- lh

- lingeries

- lovestories

- lucknow

- lyrics

- lyricshub

- medicines

- medium

- members

- mid-day

- mlm

- models

- music

- musical

- musicnews

- mx

- mylifemyyoga

- navneet

- neft

- nehakakkar

- news

- nisamachar

- nzmc

- old

- pakistan

- patc

- pib

- pics

- plok

- pltv24

- png

- polly

- pollywood

- pr

- prime

- primeautomobiles

- promotions

- ptcnews

- punjab

- punjabi

- punjabizone

- punjablive

- punjabsvera

- punjabtv

- pvideos

- pzsongs

- raag

- raagfm

- rajasthan-board

- recepie

- restaurants

- results

- reviews

- rumor

- salenaphotos

- sarkari

- sarkarinaukri

- sbirec

- search

- shayarism

- shehnaaz

- shirtless

- shop

- singers

- smartphone

- sonunigam

- spoon

- sports

- stats

- status

- sunidhi

- suta

- tamil

- telugumovieimages

- tiktok

- tmusic

- tollfree

- top10bollywood

- up

- updates

- videolyrics

- vision

- w

- wahstatus

- wallpapers

- webseries

- pz10

- years

Highlighted Posts

Recent

Loading...

Label

Advertising

Advertising / Branding

Arts & Culture

Arts & Entertainment

Associations & Organizations

Banking & Insurance

Business

Cars

Economy

Energy & Environment

Entertainment

Fashion

Finances

Health & Fitness

Health & Medicine

Industry

IT

Law & Society

Leisure

Lifestyle

Logistics & Transport

Marketing Research

Media & Telecommunications

Media Consulting

Miscellaneous

New Media & Software

Politics

Real Estate & Construction

Sport

Sports

Technology

Tourism

Traffic

Trends

Popular

- IndiaTV Business: Google News Feed: Digest for May 19, 2024

- Natural Gas Services Market to See Huge Growth by 2026 | Exxon Mobil, Royal Dutch Shell, BP

- IndiaTV Business: Google News Feed: Digest for January 29, 2024

- Business Wire India - Multimedia: Digest for March 28, 2024

- Press Information Bureau: Digest for January 15, 2024