IndiaTV Business: Google News FeedIndiaTV: Business RSS Feed |

Table of Contents

|

Finance Bill 2024: Nirmala Sitharaman proposes amendments to LTCG tax provision on immovable properties Wednesday 07 August 2024 12:59 PM UTC+00  Finance Bill 2024: Union Finance Minister Nirmala Sitharaman today (August 7) said the contentious Long Term Capital Gains (LTCG) tax proposal on real estate is being amended to give the option to taxpayers to compute tax liability under the old system or at reduced rates without indexation, and pay the lower of the two. Finance Bill 2024: Union Finance Minister Nirmala Sitharaman today (August 7) said the contentious Long Term Capital Gains (LTCG) tax proposal on real estate is being amended to give the option to taxpayers to compute tax liability under the old system or at reduced rates without indexation, and pay the lower of the two. |

Monetary Policy: RBI keeps repo rate unchanged for 9th time in a row at 6.5 pc Thursday 08 August 2024 04:38 AM UTC+00 |

RBI increases UPI transaction limit for tax payments to Rs 5 lakh Thursday 08 August 2024 05:29 AM UTC+00  In a significant update, the Reserve Bank of India (RBI) announced on Thursday that the UPI transaction limit for tax payments has been increased from Rs 1 lakh to Rs 5 lakh per transaction. This change was revealed by RBI Governor Shaktikanta Das during the announcement of the third bi-monthly monetary policy for the current financial year. In a significant update, the Reserve Bank of India (RBI) announced on Thursday that the UPI transaction limit for tax payments has been increased from Rs 1 lakh to Rs 5 lakh per transaction. This change was revealed by RBI Governor Shaktikanta Das during the announcement of the third bi-monthly monetary policy for the current financial year. |

RBI's big announcements: How will it affect common people? Here are 5 key points Thursday 08 August 2024 11:57 AM UTC+00  RBI announcements: Reserve Bank of India (RBI) Governor Shaktikanta Das announced several important decisions today. The outcomes of the Monetary Policy Committee (MPC) meeting, which began on June 6, were disclosed today. The RBI has opted to maintain the repo rate at 6.5 per cent for the ninth consecutive time. Additionally, the RBI introduced several key measures that will have a direct impact on the public. Let's explore how these changes could affect everyday people. RBI announcements: Reserve Bank of India (RBI) Governor Shaktikanta Das announced several important decisions today. The outcomes of the Monetary Policy Committee (MPC) meeting, which began on June 6, were disclosed today. The RBI has opted to maintain the repo rate at 6.5 per cent for the ninth consecutive time. Additionally, the RBI introduced several key measures that will have a direct impact on the public. Let's explore how these changes could affect everyday people. |

Stock market update: Sensex soars 800 points, Nifty crosses 24,350 mark Friday 09 August 2024 04:23 AM UTC+00  Indian markets witnessed heavy buying at the opening bell on Friday. The benchmark BSE Sensex jumped 789 points to reach 79,675, while the Nifty50 climbed by 0.98%, adding 235 points to settle at 24,352. The rally was driven by gains across all sectors, with IT stocks such as Tech Mahindra, Infosys, TCS, and HCL Tech leading the charge, each gaining around 2%. Indian markets witnessed heavy buying at the opening bell on Friday. The benchmark BSE Sensex jumped 789 points to reach 79,675, while the Nifty50 climbed by 0.98%, adding 235 points to settle at 24,352. The rally was driven by gains across all sectors, with IT stocks such as Tech Mahindra, Infosys, TCS, and HCL Tech leading the charge, each gaining around 2%. |

HDFC Bank UPI services to be down tomorrow: Check timing, list of services to be affected Friday 09 August 2024 10:57 AM UTC+00  Attention bank customers! The HDFC bank alerted its customers with a message that the UPI services will be down on Saturday due to scheduled maintenance and various services such as mobile banking app including GPay, Paytm, WhatsApp Pay and others would remain unavailable for three hours on August 10. In a mail sent to several users, the HDFC bank stated that HDFC Bank UPI services will remain unavailable and added that the UPI downtime would help them improve the efficiency of their services. Attention bank customers! The HDFC bank alerted its customers with a message that the UPI services will be down on Saturday due to scheduled maintenance and various services such as mobile banking app including GPay, Paytm, WhatsApp Pay and others would remain unavailable for three hours on August 10. In a mail sent to several users, the HDFC bank stated that HDFC Bank UPI services will remain unavailable and added that the UPI downtime would help them improve the efficiency of their services. |

Closing market: Sensex jumps 819 points on global stocks rally, auto and IT stocks outshine Friday 09 August 2024 12:15 PM UTC+00 |

Union Bank of India hikes FD Interest rates for senior citizens: Check revised rates here Friday 09 August 2024 12:54 PM UTC+00  Here comes a piece of good news for bank customers who have fixed deposits in the Union Bank of India. The bank revised its interest rates on fixed deposits and said it is offering a special interest rate of 7.4% to regular citizens for term deposits with a 333-day tenure. The bank also said it has increased fixed deposit (FD) interest rates for FDs of up to Rs 3 crore. Here comes a piece of good news for bank customers who have fixed deposits in the Union Bank of India. The bank revised its interest rates on fixed deposits and said it is offering a special interest rate of 7.4% to regular citizens for term deposits with a 333-day tenure. The bank also said it has increased fixed deposit (FD) interest rates for FDs of up to Rs 3 crore. |

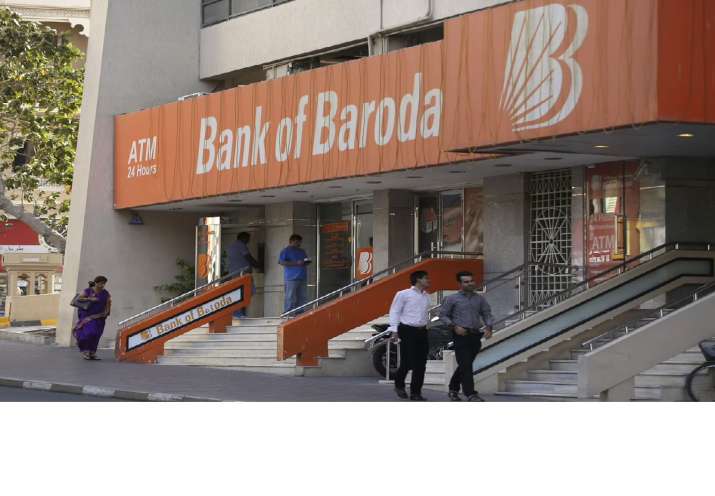

Attention bank customers: Loan EMIs to go up as Bank of Baroda hikes lending rates by 5 bps Saturday 10 August 2024 09:06 AM UTC+00  The Bank of Baroda on Friday announced hike in lending rates by 5 basis points (bps) on 3-month, 6-month, and 1-year tenures, with effect from August 12, 2024. As peer the regulatory filing by the bank on August 9, the bank said it has reviewed/ changed marginal cost of funds based lending rate (MCLR) with effect from August 12, 2024. With the latest hike in the marginal cost of funds-based lending rates (MCLR), the loan EMIs will increase for borrowers. The Bank of Baroda on Friday announced hike in lending rates by 5 basis points (bps) on 3-month, 6-month, and 1-year tenures, with effect from August 12, 2024. As peer the regulatory filing by the bank on August 9, the bank said it has reviewed/ changed marginal cost of funds based lending rate (MCLR) with effect from August 12, 2024. With the latest hike in the marginal cost of funds-based lending rates (MCLR), the loan EMIs will increase for borrowers. |

Banks urged to focus on core business, innovate for higher deposits: FM Sitharaman Saturday 10 August 2024 09:24 AM UTC+00  Union Finance Minister Nirmala Sitharaman has called on banks to concentrate on their core business activities, emphasising the importance of innovative products to increase deposits. She highlighted the need for stricter deposit collection and lending practices while addressing a press conference following a post-budget meeting with the RBI. Union Finance Minister Nirmala Sitharaman has called on banks to concentrate on their core business activities, emphasising the importance of innovative products to increase deposits. She highlighted the need for stricter deposit collection and lending practices while addressing a press conference following a post-budget meeting with the RBI. |

Monetary Policy: RBI keeps repo rate unchanged for 9th time in a row at 6.5 pc Thursday 08 August 2024 04:38 AM UTC+00 |

RBI increases UPI transaction limit for tax payments to Rs 5 lakh Thursday 08 August 2024 05:29 AM UTC+00  In a significant update, the Reserve Bank of India (RBI) announced on Thursday that the UPI transaction limit for tax payments has been increased from Rs 1 lakh to Rs 5 lakh per transaction. This change was revealed by RBI Governor Shaktikanta Das during the announcement of the third bi-monthly monetary policy for the current financial year. In a significant update, the Reserve Bank of India (RBI) announced on Thursday that the UPI transaction limit for tax payments has been increased from Rs 1 lakh to Rs 5 lakh per transaction. This change was revealed by RBI Governor Shaktikanta Das during the announcement of the third bi-monthly monetary policy for the current financial year. |

RBI's big announcements: How will it affect common people? Here are 5 key points Thursday 08 August 2024 11:57 AM UTC+00  RBI announcements: Reserve Bank of India (RBI) Governor Shaktikanta Das announced several important decisions today. The outcomes of the Monetary Policy Committee (MPC) meeting, which began on June 6, were disclosed today. The RBI has opted to maintain the repo rate at 6.5 per cent for the ninth consecutive time. Additionally, the RBI introduced several key measures that will have a direct impact on the public. Let's explore how these changes could affect everyday people. RBI announcements: Reserve Bank of India (RBI) Governor Shaktikanta Das announced several important decisions today. The outcomes of the Monetary Policy Committee (MPC) meeting, which began on June 6, were disclosed today. The RBI has opted to maintain the repo rate at 6.5 per cent for the ninth consecutive time. Additionally, the RBI introduced several key measures that will have a direct impact on the public. Let's explore how these changes could affect everyday people. |

Stock market update: Sensex soars 800 points, Nifty crosses 24,350 mark Friday 09 August 2024 04:23 AM UTC+00  Indian markets witnessed heavy buying at the opening bell on Friday. The benchmark BSE Sensex jumped 789 points to reach 79,675, while the Nifty50 climbed by 0.98%, adding 235 points to settle at 24,352. The rally was driven by gains across all sectors, with IT stocks such as Tech Mahindra, Infosys, TCS, and HCL Tech leading the charge, each gaining around 2%. Indian markets witnessed heavy buying at the opening bell on Friday. The benchmark BSE Sensex jumped 789 points to reach 79,675, while the Nifty50 climbed by 0.98%, adding 235 points to settle at 24,352. The rally was driven by gains across all sectors, with IT stocks such as Tech Mahindra, Infosys, TCS, and HCL Tech leading the charge, each gaining around 2%. |

HDFC Bank UPI services to be down tomorrow: Check timing, list of services to be affected Friday 09 August 2024 10:57 AM UTC+00  Attention bank customers! The HDFC bank alerted its customers with a message that the UPI services will be down on Saturday due to scheduled maintenance and various services such as mobile banking app including GPay, Paytm, WhatsApp Pay and others would remain unavailable for three hours on August 10. In a mail sent to several users, the HDFC bank stated that HDFC Bank UPI services will remain unavailable and added that the UPI downtime would help them improve the efficiency of their services. Attention bank customers! The HDFC bank alerted its customers with a message that the UPI services will be down on Saturday due to scheduled maintenance and various services such as mobile banking app including GPay, Paytm, WhatsApp Pay and others would remain unavailable for three hours on August 10. In a mail sent to several users, the HDFC bank stated that HDFC Bank UPI services will remain unavailable and added that the UPI downtime would help them improve the efficiency of their services. |

Closing market: Sensex jumps 819 points on global stocks rally, auto and IT stocks outshine Friday 09 August 2024 12:15 PM UTC+00 |

Union Bank of India hikes FD Interest rates for senior citizens: Check revised rates here Friday 09 August 2024 12:54 PM UTC+00  Here comes a piece of good news for bank customers who have fixed deposits in the Union Bank of India. The bank revised its interest rates on fixed deposits and said it is offering a special interest rate of 7.4% to regular citizens for term deposits with a 333-day tenure. The bank also said it has increased fixed deposit (FD) interest rates for FDs of up to Rs 3 crore. Here comes a piece of good news for bank customers who have fixed deposits in the Union Bank of India. The bank revised its interest rates on fixed deposits and said it is offering a special interest rate of 7.4% to regular citizens for term deposits with a 333-day tenure. The bank also said it has increased fixed deposit (FD) interest rates for FDs of up to Rs 3 crore. |

Attention bank customers: Loan EMIs to go up as Bank of Baroda hikes lending rates by 5 bps Saturday 10 August 2024 09:06 AM UTC+00  The Bank of Baroda on Friday announced hike in lending rates by 5 basis points (bps) on 3-month, 6-month, and 1-year tenures, with effect from August 12, 2024. As peer the regulatory filing by the bank on August 9, the bank said it has reviewed/ changed marginal cost of funds based lending rate (MCLR) with effect from August 12, 2024. With the latest hike in the marginal cost of funds-based lending rates (MCLR), the loan EMIs will increase for borrowers. The Bank of Baroda on Friday announced hike in lending rates by 5 basis points (bps) on 3-month, 6-month, and 1-year tenures, with effect from August 12, 2024. As peer the regulatory filing by the bank on August 9, the bank said it has reviewed/ changed marginal cost of funds based lending rate (MCLR) with effect from August 12, 2024. With the latest hike in the marginal cost of funds-based lending rates (MCLR), the loan EMIs will increase for borrowers. |

Banks urged to focus on core business, innovate for higher deposits: FM Sitharaman Saturday 10 August 2024 09:24 AM UTC+00  Union Finance Minister Nirmala Sitharaman has called on banks to concentrate on their core business activities, emphasising the importance of innovative products to increase deposits. She highlighted the need for stricter deposit collection and lending practices while addressing a press conference following a post-budget meeting with the RBI. Union Finance Minister Nirmala Sitharaman has called on banks to concentrate on their core business activities, emphasising the importance of innovative products to increase deposits. She highlighted the need for stricter deposit collection and lending practices while addressing a press conference following a post-budget meeting with the RBI. |

Adani Group reacts to Hindenburg's allegation against Sebi chief, calls it 'a red herring' Sunday 11 August 2024 07:23 AM UTC+00 |

Monetary Policy: RBI keeps repo rate unchanged for 9th time in a row at 6.5 pc Thursday 08 August 2024 04:38 AM UTC+00 |

RBI increases UPI transaction limit for tax payments to Rs 5 lakh Thursday 08 August 2024 05:29 AM UTC+00  In a significant update, the Reserve Bank of India (RBI) announced on Thursday that the UPI transaction limit for tax payments has been increased from Rs 1 lakh to Rs 5 lakh per transaction. This change was revealed by RBI Governor Shaktikanta Das during the announcement of the third bi-monthly monetary policy for the current financial year. In a significant update, the Reserve Bank of India (RBI) announced on Thursday that the UPI transaction limit for tax payments has been increased from Rs 1 lakh to Rs 5 lakh per transaction. This change was revealed by RBI Governor Shaktikanta Das during the announcement of the third bi-monthly monetary policy for the current financial year. |

RBI's big announcements: How will it affect common people? Here are 5 key points Thursday 08 August 2024 11:57 AM UTC+00  RBI announcements: Reserve Bank of India (RBI) Governor Shaktikanta Das announced several important decisions today. The outcomes of the Monetary Policy Committee (MPC) meeting, which began on June 6, were disclosed today. The RBI has opted to maintain the repo rate at 6.5 per cent for the ninth consecutive time. Additionally, the RBI introduced several key measures that will have a direct impact on the public. Let's explore how these changes could affect everyday people. RBI announcements: Reserve Bank of India (RBI) Governor Shaktikanta Das announced several important decisions today. The outcomes of the Monetary Policy Committee (MPC) meeting, which began on June 6, were disclosed today. The RBI has opted to maintain the repo rate at 6.5 per cent for the ninth consecutive time. Additionally, the RBI introduced several key measures that will have a direct impact on the public. Let's explore how these changes could affect everyday people. |

Stock market update: Sensex soars 800 points, Nifty crosses 24,350 mark Friday 09 August 2024 04:23 AM UTC+00  Indian markets witnessed heavy buying at the opening bell on Friday. The benchmark BSE Sensex jumped 789 points to reach 79,675, while the Nifty50 climbed by 0.98%, adding 235 points to settle at 24,352. The rally was driven by gains across all sectors, with IT stocks such as Tech Mahindra, Infosys, TCS, and HCL Tech leading the charge, each gaining around 2%. Indian markets witnessed heavy buying at the opening bell on Friday. The benchmark BSE Sensex jumped 789 points to reach 79,675, while the Nifty50 climbed by 0.98%, adding 235 points to settle at 24,352. The rally was driven by gains across all sectors, with IT stocks such as Tech Mahindra, Infosys, TCS, and HCL Tech leading the charge, each gaining around 2%. |

HDFC Bank UPI services to be down tomorrow: Check timing, list of services to be affected Friday 09 August 2024 10:57 AM UTC+00  Attention bank customers! The HDFC bank alerted its customers with a message that the UPI services will be down on Saturday due to scheduled maintenance and various services such as mobile banking app including GPay, Paytm, WhatsApp Pay and others would remain unavailable for three hours on August 10. In a mail sent to several users, the HDFC bank stated that HDFC Bank UPI services will remain unavailable and added that the UPI downtime would help them improve the efficiency of their services. Attention bank customers! The HDFC bank alerted its customers with a message that the UPI services will be down on Saturday due to scheduled maintenance and various services such as mobile banking app including GPay, Paytm, WhatsApp Pay and others would remain unavailable for three hours on August 10. In a mail sent to several users, the HDFC bank stated that HDFC Bank UPI services will remain unavailable and added that the UPI downtime would help them improve the efficiency of their services. |

Closing market: Sensex jumps 819 points on global stocks rally, auto and IT stocks outshine Friday 09 August 2024 12:15 PM UTC+00 |

Union Bank of India hikes FD Interest rates for senior citizens: Check revised rates here Friday 09 August 2024 12:54 PM UTC+00  Here comes a piece of good news for bank customers who have fixed deposits in the Union Bank of India. The bank revised its interest rates on fixed deposits and said it is offering a special interest rate of 7.4% to regular citizens for term deposits with a 333-day tenure. The bank also said it has increased fixed deposit (FD) interest rates for FDs of up to Rs 3 crore. Here comes a piece of good news for bank customers who have fixed deposits in the Union Bank of India. The bank revised its interest rates on fixed deposits and said it is offering a special interest rate of 7.4% to regular citizens for term deposits with a 333-day tenure. The bank also said it has increased fixed deposit (FD) interest rates for FDs of up to Rs 3 crore. |

Attention bank customers: Loan EMIs to go up as Bank of Baroda hikes lending rates by 5 bps Saturday 10 August 2024 09:06 AM UTC+00  The Bank of Baroda on Friday announced hike in lending rates by 5 basis points (bps) on 3-month, 6-month, and 1-year tenures, with effect from August 12, 2024. As peer the regulatory filing by the bank on August 9, the bank said it has reviewed/ changed marginal cost of funds based lending rate (MCLR) with effect from August 12, 2024. With the latest hike in the marginal cost of funds-based lending rates (MCLR), the loan EMIs will increase for borrowers. The Bank of Baroda on Friday announced hike in lending rates by 5 basis points (bps) on 3-month, 6-month, and 1-year tenures, with effect from August 12, 2024. As peer the regulatory filing by the bank on August 9, the bank said it has reviewed/ changed marginal cost of funds based lending rate (MCLR) with effect from August 12, 2024. With the latest hike in the marginal cost of funds-based lending rates (MCLR), the loan EMIs will increase for borrowers. |

Banks urged to focus on core business, innovate for higher deposits: FM Sitharaman Saturday 10 August 2024 09:24 AM UTC+00  Union Finance Minister Nirmala Sitharaman has called on banks to concentrate on their core business activities, emphasising the importance of innovative products to increase deposits. She highlighted the need for stricter deposit collection and lending practices while addressing a press conference following a post-budget meeting with the RBI. Union Finance Minister Nirmala Sitharaman has called on banks to concentrate on their core business activities, emphasising the importance of innovative products to increase deposits. She highlighted the need for stricter deposit collection and lending practices while addressing a press conference following a post-budget meeting with the RBI. |

Adani Group reacts to Hindenburg's allegation against Sebi chief, calls it 'a red herring' Sunday 11 August 2024 07:23 AM UTC+00 |

RBI increases UPI transaction limit for tax payments to Rs 5 lakh Thursday 08 August 2024 05:29 AM UTC+00  In a significant update, the Reserve Bank of India (RBI) announced on Thursday that the UPI transaction limit for tax payments has been increased from Rs 1 lakh to Rs 5 lakh per transaction. This change was revealed by RBI Governor Shaktikanta Das during the announcement of the third bi-monthly monetary policy for the current financial year. In a significant update, the Reserve Bank of India (RBI) announced on Thursday that the UPI transaction limit for tax payments has been increased from Rs 1 lakh to Rs 5 lakh per transaction. This change was revealed by RBI Governor Shaktikanta Das during the announcement of the third bi-monthly monetary policy for the current financial year. |

RBI's big announcements: How will it affect common people? Here are 5 key points Thursday 08 August 2024 11:57 AM UTC+00  RBI announcements: Reserve Bank of India (RBI) Governor Shaktikanta Das announced several important decisions today. The outcomes of the Monetary Policy Committee (MPC) meeting, which began on June 6, were disclosed today. The RBI has opted to maintain the repo rate at 6.5 per cent for the ninth consecutive time. Additionally, the RBI introduced several key measures that will have a direct impact on the public. Let's explore how these changes could affect everyday people. RBI announcements: Reserve Bank of India (RBI) Governor Shaktikanta Das announced several important decisions today. The outcomes of the Monetary Policy Committee (MPC) meeting, which began on June 6, were disclosed today. The RBI has opted to maintain the repo rate at 6.5 per cent for the ninth consecutive time. Additionally, the RBI introduced several key measures that will have a direct impact on the public. Let's explore how these changes could affect everyday people. |

Stock market update: Sensex soars 800 points, Nifty crosses 24,350 mark Friday 09 August 2024 04:23 AM UTC+00  Indian markets witnessed heavy buying at the opening bell on Friday. The benchmark BSE Sensex jumped 789 points to reach 79,675, while the Nifty50 climbed by 0.98%, adding 235 points to settle at 24,352. The rally was driven by gains across all sectors, with IT stocks such as Tech Mahindra, Infosys, TCS, and HCL Tech leading the charge, each gaining around 2%. Indian markets witnessed heavy buying at the opening bell on Friday. The benchmark BSE Sensex jumped 789 points to reach 79,675, while the Nifty50 climbed by 0.98%, adding 235 points to settle at 24,352. The rally was driven by gains across all sectors, with IT stocks such as Tech Mahindra, Infosys, TCS, and HCL Tech leading the charge, each gaining around 2%. |

HDFC Bank UPI services to be down tomorrow: Check timing, list of services to be affected Friday 09 August 2024 10:57 AM UTC+00  Attention bank customers! The HDFC bank alerted its customers with a message that the UPI services will be down on Saturday due to scheduled maintenance and various services such as mobile banking app including GPay, Paytm, WhatsApp Pay and others would remain unavailable for three hours on August 10. In a mail sent to several users, the HDFC bank stated that HDFC Bank UPI services will remain unavailable and added that the UPI downtime would help them improve the efficiency of their services. Attention bank customers! The HDFC bank alerted its customers with a message that the UPI services will be down on Saturday due to scheduled maintenance and various services such as mobile banking app including GPay, Paytm, WhatsApp Pay and others would remain unavailable for three hours on August 10. In a mail sent to several users, the HDFC bank stated that HDFC Bank UPI services will remain unavailable and added that the UPI downtime would help them improve the efficiency of their services. |

Closing market: Sensex jumps 819 points on global stocks rally, auto and IT stocks outshine Friday 09 August 2024 12:15 PM UTC+00 |

Union Bank of India hikes FD Interest rates for senior citizens: Check revised rates here Friday 09 August 2024 12:54 PM UTC+00  Here comes a piece of good news for bank customers who have fixed deposits in the Union Bank of India. The bank revised its interest rates on fixed deposits and said it is offering a special interest rate of 7.4% to regular citizens for term deposits with a 333-day tenure. The bank also said it has increased fixed deposit (FD) interest rates for FDs of up to Rs 3 crore. Here comes a piece of good news for bank customers who have fixed deposits in the Union Bank of India. The bank revised its interest rates on fixed deposits and said it is offering a special interest rate of 7.4% to regular citizens for term deposits with a 333-day tenure. The bank also said it has increased fixed deposit (FD) interest rates for FDs of up to Rs 3 crore. |

Attention bank customers: Loan EMIs to go up as Bank of Baroda hikes lending rates by 5 bps Saturday 10 August 2024 09:06 AM UTC+00  The Bank of Baroda on Friday announced hike in lending rates by 5 basis points (bps) on 3-month, 6-month, and 1-year tenures, with effect from August 12, 2024. As peer the regulatory filing by the bank on August 9, the bank said it has reviewed/ changed marginal cost of funds based lending rate (MCLR) with effect from August 12, 2024. With the latest hike in the marginal cost of funds-based lending rates (MCLR), the loan EMIs will increase for borrowers. The Bank of Baroda on Friday announced hike in lending rates by 5 basis points (bps) on 3-month, 6-month, and 1-year tenures, with effect from August 12, 2024. As peer the regulatory filing by the bank on August 9, the bank said it has reviewed/ changed marginal cost of funds based lending rate (MCLR) with effect from August 12, 2024. With the latest hike in the marginal cost of funds-based lending rates (MCLR), the loan EMIs will increase for borrowers. |

Banks urged to focus on core business, innovate for higher deposits: FM Sitharaman Saturday 10 August 2024 09:24 AM UTC+00  Union Finance Minister Nirmala Sitharaman has called on banks to concentrate on their core business activities, emphasising the importance of innovative products to increase deposits. She highlighted the need for stricter deposit collection and lending practices while addressing a press conference following a post-budget meeting with the RBI. Union Finance Minister Nirmala Sitharaman has called on banks to concentrate on their core business activities, emphasising the importance of innovative products to increase deposits. She highlighted the need for stricter deposit collection and lending practices while addressing a press conference following a post-budget meeting with the RBI. |

Adani Group reacts to Hindenburg's allegation against Sebi chief, calls it 'a red herring' Sunday 11 August 2024 07:23 AM UTC+00 |

Want to do FD? Know which govt bank offers highest interest rate on fixed deposits Sunday 11 August 2024 12:26 PM UTC+00  Fixed deposits: In the past two months, several public sector banks (PSUs) have adjusted their fixed deposit (FD) interest rates. In August, banks such as Union Bank, Bank of India, and Punjab National Bank updated their FD rates. Currently, Union Bank of India offers the highest interest rate of up to 7.40 per cent per annum on FDs with a tenure of 333 days. Additionally, senior citizens (aged 60 and above) receive an extra 0.50 per cent interest, while super senior citizens (above 80 years) are granted an additional 0.75 per cent on their FDs. Fixed deposits: In the past two months, several public sector banks (PSUs) have adjusted their fixed deposit (FD) interest rates. In August, banks such as Union Bank, Bank of India, and Punjab National Bank updated their FD rates. Currently, Union Bank of India offers the highest interest rate of up to 7.40 per cent per annum on FDs with a tenure of 333 days. Additionally, senior citizens (aged 60 and above) receive an extra 0.50 per cent interest, while super senior citizens (above 80 years) are granted an additional 0.75 per cent on their FDs. |

RBI increases UPI transaction limit for tax payments to Rs 5 lakh Thursday 08 August 2024 05:29 AM UTC+00  In a significant update, the Reserve Bank of India (RBI) announced on Thursday that the UPI transaction limit for tax payments has been increased from Rs 1 lakh to Rs 5 lakh per transaction. This change was revealed by RBI Governor Shaktikanta Das during the announcement of the third bi-monthly monetary policy for the current financial year. In a significant update, the Reserve Bank of India (RBI) announced on Thursday that the UPI transaction limit for tax payments has been increased from Rs 1 lakh to Rs 5 lakh per transaction. This change was revealed by RBI Governor Shaktikanta Das during the announcement of the third bi-monthly monetary policy for the current financial year. |

RBI's big announcements: How will it affect common people? Here are 5 key points Thursday 08 August 2024 11:57 AM UTC+00  RBI announcements: Reserve Bank of India (RBI) Governor Shaktikanta Das announced several important decisions today. The outcomes of the Monetary Policy Committee (MPC) meeting, which began on June 6, were disclosed today. The RBI has opted to maintain the repo rate at 6.5 per cent for the ninth consecutive time. Additionally, the RBI introduced several key measures that will have a direct impact on the public. Let's explore how these changes could affect everyday people. RBI announcements: Reserve Bank of India (RBI) Governor Shaktikanta Das announced several important decisions today. The outcomes of the Monetary Policy Committee (MPC) meeting, which began on June 6, were disclosed today. The RBI has opted to maintain the repo rate at 6.5 per cent for the ninth consecutive time. Additionally, the RBI introduced several key measures that will have a direct impact on the public. Let's explore how these changes could affect everyday people. |

Stock market update: Sensex soars 800 points, Nifty crosses 24,350 mark Friday 09 August 2024 04:23 AM UTC+00  Indian markets witnessed heavy buying at the opening bell on Friday. The benchmark BSE Sensex jumped 789 points to reach 79,675, while the Nifty50 climbed by 0.98%, adding 235 points to settle at 24,352. The rally was driven by gains across all sectors, with IT stocks such as Tech Mahindra, Infosys, TCS, and HCL Tech leading the charge, each gaining around 2%. Indian markets witnessed heavy buying at the opening bell on Friday. The benchmark BSE Sensex jumped 789 points to reach 79,675, while the Nifty50 climbed by 0.98%, adding 235 points to settle at 24,352. The rally was driven by gains across all sectors, with IT stocks such as Tech Mahindra, Infosys, TCS, and HCL Tech leading the charge, each gaining around 2%. |

HDFC Bank UPI services to be down tomorrow: Check timing, list of services to be affected Friday 09 August 2024 10:57 AM UTC+00  Attention bank customers! The HDFC bank alerted its customers with a message that the UPI services will be down on Saturday due to scheduled maintenance and various services such as mobile banking app including GPay, Paytm, WhatsApp Pay and others would remain unavailable for three hours on August 10. In a mail sent to several users, the HDFC bank stated that HDFC Bank UPI services will remain unavailable and added that the UPI downtime would help them improve the efficiency of their services. Attention bank customers! The HDFC bank alerted its customers with a message that the UPI services will be down on Saturday due to scheduled maintenance and various services such as mobile banking app including GPay, Paytm, WhatsApp Pay and others would remain unavailable for three hours on August 10. In a mail sent to several users, the HDFC bank stated that HDFC Bank UPI services will remain unavailable and added that the UPI downtime would help them improve the efficiency of their services. |

Closing market: Sensex jumps 819 points on global stocks rally, auto and IT stocks outshine Friday 09 August 2024 12:15 PM UTC+00 |

Union Bank of India hikes FD Interest rates for senior citizens: Check revised rates here Friday 09 August 2024 12:54 PM UTC+00  Here comes a piece of good news for bank customers who have fixed deposits in the Union Bank of India. The bank revised its interest rates on fixed deposits and said it is offering a special interest rate of 7.4% to regular citizens for term deposits with a 333-day tenure. The bank also said it has increased fixed deposit (FD) interest rates for FDs of up to Rs 3 crore. Here comes a piece of good news for bank customers who have fixed deposits in the Union Bank of India. The bank revised its interest rates on fixed deposits and said it is offering a special interest rate of 7.4% to regular citizens for term deposits with a 333-day tenure. The bank also said it has increased fixed deposit (FD) interest rates for FDs of up to Rs 3 crore. |

Attention bank customers: Loan EMIs to go up as Bank of Baroda hikes lending rates by 5 bps Saturday 10 August 2024 09:06 AM UTC+00  The Bank of Baroda on Friday announced hike in lending rates by 5 basis points (bps) on 3-month, 6-month, and 1-year tenures, with effect from August 12, 2024. As peer the regulatory filing by the bank on August 9, the bank said it has reviewed/ changed marginal cost of funds based lending rate (MCLR) with effect from August 12, 2024. With the latest hike in the marginal cost of funds-based lending rates (MCLR), the loan EMIs will increase for borrowers. The Bank of Baroda on Friday announced hike in lending rates by 5 basis points (bps) on 3-month, 6-month, and 1-year tenures, with effect from August 12, 2024. As peer the regulatory filing by the bank on August 9, the bank said it has reviewed/ changed marginal cost of funds based lending rate (MCLR) with effect from August 12, 2024. With the latest hike in the marginal cost of funds-based lending rates (MCLR), the loan EMIs will increase for borrowers. |

Banks urged to focus on core business, innovate for higher deposits: FM Sitharaman Saturday 10 August 2024 09:24 AM UTC+00  Union Finance Minister Nirmala Sitharaman has called on banks to concentrate on their core business activities, emphasising the importance of innovative products to increase deposits. She highlighted the need for stricter deposit collection and lending practices while addressing a press conference following a post-budget meeting with the RBI. Union Finance Minister Nirmala Sitharaman has called on banks to concentrate on their core business activities, emphasising the importance of innovative products to increase deposits. She highlighted the need for stricter deposit collection and lending practices while addressing a press conference following a post-budget meeting with the RBI. |

Adani Group reacts to Hindenburg's allegation against Sebi chief, calls it 'a red herring' Sunday 11 August 2024 07:23 AM UTC+00 |

Want to do FD? Know which govt bank offers highest interest rate on fixed deposits Sunday 11 August 2024 12:26 PM UTC+00  Fixed deposits: In the past two months, several public sector banks (PSUs) have adjusted their fixed deposit (FD) interest rates. In August, banks such as Union Bank, Bank of India, and Punjab National Bank updated their FD rates. Currently, Union Bank of India offers the highest interest rate of up to 7.40 per cent per annum on FDs with a tenure of 333 days. Additionally, senior citizens (aged 60 and above) receive an extra 0.50 per cent interest, while super senior citizens (above 80 years) are granted an additional 0.75 per cent on their FDs. Fixed deposits: In the past two months, several public sector banks (PSUs) have adjusted their fixed deposit (FD) interest rates. In August, banks such as Union Bank, Bank of India, and Punjab National Bank updated their FD rates. Currently, Union Bank of India offers the highest interest rate of up to 7.40 per cent per annum on FDs with a tenure of 333 days. Additionally, senior citizens (aged 60 and above) receive an extra 0.50 per cent interest, while super senior citizens (above 80 years) are granted an additional 0.75 per cent on their FDs. |

| You received this email because you set up a subscription at Feedrabbit. This email was sent to you at epaperindia10@gmail.com. Unsubscribe or change your subscription. |

Ad Unit (Iklan) BIG

Home

› Uncategorized

Related Posts

There is no other posts in this category.Recent

Loading...

Choose Hit Lists Category

- 365hindi

- actors

- actresses

- affidavits

- afghanistan

- akshaykumar

- apt

- asianmodels

- audi

- autos

- ba

- bba

- bevents

- bhaktigaane

- billboard

- bing

- birthdaywishes

- blog

- blugaa

- bm

- bollywood

- bollywoodhd

- budget

- cbse

- cbsenic

- celb

- celebritycars

- celebrityinsider

- chart

- cinema

- cricbuzz

- dailypost

- documentary

- drunkenstepfather

- education

- egotasticsports

- elections

- events

- evilbeetgossip

- fashion101

- festivals

- filmyquotes

- filthy

- free

- gazeis

- glambase

- glamgossip

- gold

- gossips

- gulte

- hd

- hdgallery

- health

- hindi

- hindi18

- hindibhajan

- hindinews18

- hindisamay

- hindisongs

- horoscope

- horror

- hsongs

- htracks

- icelebritieshub

- ifsc

- indiaresults

- indiatv

- info

- insta

- jobs

- kabaddi

- karnataka

- kashmir

- kkpop

- lallantop

- letters

- lh

- lingeries

- lovestories

- lucknow

- lyrics

- lyricshub

- medicines

- medium

- members

- mid-day

- mlm

- models

- music

- musical

- musicnews

- mx

- mylifemyyoga

- navneet

- neft

- nehakakkar

- news

- nisamachar

- nzmc

- old

- pakistan

- patc

- pib

- pics

- plok

- pltv24

- png

- polly

- pollywood

- pr

- prime

- primeautomobiles

- promotions

- ptcnews

- punjab

- punjabi

- punjabizone

- punjablive

- punjabsvera

- punjabtv

- pvideos

- pzsongs

- raag

- raagfm

- rajasthan-board

- recepie

- restaurants

- results

- reviews

- rumor

- salenaphotos

- sarkari

- sarkarinaukri

- sbirec

- search

- shayarism

- shehnaaz

- shirtless

- shop

- singers

- smartphone

- sonunigam

- spoon

- sports

- stats

- status

- sunidhi

- suta

- tamil

- telugumovieimages

- tiktok

- tmusic

- tollfree

- top10bollywood

- up

- updates

- videolyrics

- vision

- w

- wahstatus

- wallpapers

- webseries

- pz10

- years

Highlighted Posts

Recent

Loading...

Label

Advertising

Advertising / Branding

Arts & Culture

Arts & Entertainment

Associations & Organizations

Banking & Insurance

Business

Cars

Economy

Energy & Environment

Entertainment

Fashion

Finances

Health & Fitness

Health & Medicine

Industry

IT

Law & Society

Leisure

Lifestyle

Logistics & Transport

Marketing Research

Media & Telecommunications

Media Consulting

Miscellaneous

New Media & Software

Politics

Real Estate & Construction

Sport

Sports

Technology

Tourism

Traffic

Trends

Popular

- Business Wire India - Multimedia: Digest for December 19, 2023

- Business Wire India - Multimedia: Digest for May 27, 2023

- Enterprise WLAN Market Expected to Witness a Sustainable Growth over 2027 | Juniper Networks, LANCOM Systems GmbH, Netgear, Ruijie Networks | openPR.com - New Public Relations: Business, Economy, Finances, Banking & Insurance

- Know Which Factors are increasing Compound Annual Growth Rate (CAGR) of Organic Waste Recycling market in upcoming year? | openPR.com - New Public Relations: IT, New Media & Software

- Business Wire India - Multimedia: Digest for February 17, 2023